Modeling Equity-Indexed Annuities with MATLAB

In this webinar, you will see how you can use MATLAB to develop and deploy insurance models within financial services. The webinar follows the creation of an equity-indexed annuity product from its inception through data integration, analysis, modeling, and finally deployment. The example shown will demonstrate how the capabilities of MathWorks products can benefit insurers.

Webinar highlights include:

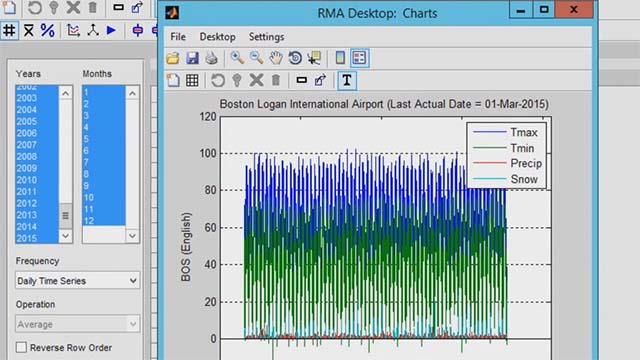

- Integrating data sources

- Valuing and creating an equity-indexed annuity product

- Developing and deploying applications

This webinar is relevant to practitioners or academics in finance whose focus is quantitative analysis, modeling, risk analysis, and valuation—particularly but not exclusively actuaries and professionals in the insurance industry. Familiarity with MATLAB is helpful, but not required.

About the Presenter: Yi Wang holds a Bachelor of Applied Science in Computer Engineering from the University of Toronto and an M.S. in Computer Science from the University of Southern California. Since joining MathWorks as an application engineer in 2007, Yi has supported the financial services industry in adopting MathWorks tools in financial modeling, application deployment and parallel computing. Yi completed the Canadian Security Course in 2001 and passed the CFA Level II exam in 2010.

Recorded: 15 Nov 2011