autocorr

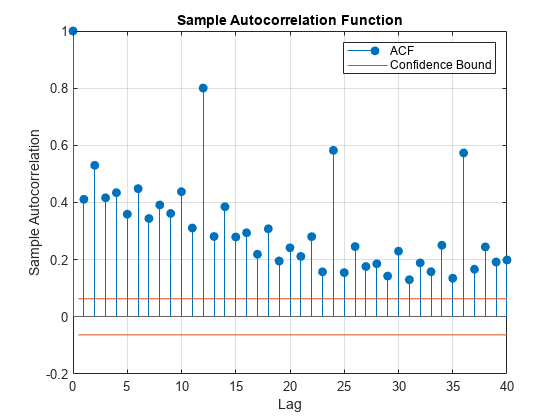

Sample autocorrelation

Syntax

Description

[

returns the sample autocorrelation function (ACF)

and associated lags of the input univariate time series.acf,lags] = autocorr(y)

ACFTbl = autocorr(Tbl)DataVariable name-value argument. (since R2022a)

[___, uses any input-argument combination in the previous

syntaxes, and returns the output-argument combination for the corresponding input

arguments and the approximate upper and lower confidence bounds on the ACF.bounds]

= autocorr(___)

[___] = autocorr(___,

uses additional options specified by one or more name-value arguments. For example,

Name=Value)autocorr(Tbl,DataVariable="RGDP",NumLags=10,NumSTD=1.96) returns 10

lags of the sample ACF of the table variable "RGDP" in

Tbl and 95% confidence bounds.

autocorr(___) plots the sample ACF of the input

series with confidence bounds.

autocorr(

plots on the axes specified by ax,___)ax instead of

the current axes (gca). ax can precede any of the input

argument combinations in the previous syntaxes.

[___, plots the sample ACF of the input series and

additionally returns handles to plotted graphics objects. Use elements of

h]

= autocorr(___)h to modify properties of the plot after you create it.

Examples

Input Arguments

Name-Value Arguments

Output Arguments

More About

Tips

To plot the ACF without confidence bounds, set

NumSTD=0.

Algorithms

If the input series is a fully observed series (that is, it does not contain any

NaNvalues),autocorruses a Fourier transform to compute the ACF in the frequency domain, then converts back to the time domain using an inverse Fourier transform.If the input series is not fully observed (that is, it contains at least one

NaNvalue),autocorrcomputes the ACF at lag k in the time domain, and includes in the sample average only those terms for which the cross product ytyt+k exists. Consequently, the effective sample size is a random variable.autocorrplots the ACF when you do not return any output or when you return the fourth outputh.

References

[1] Box, George E. P., Gwilym M. Jenkins, and Gregory C. Reinsel. Time Series Analysis: Forecasting and Control. 3rd ed. Englewood Cliffs, NJ: Prentice Hall, 1994.

[2] Hamilton, James D. Time Series Analysis. Princeton, NJ: Princeton University Press, 1994.