simulate

Monte Carlo simulation of conditional variance models

Syntax

Description

V = simulate(Mdl,numobs,Name=Value)simulate(Mdl,100,NumPaths=1000,V0=v0) returns a numeric

matrix of 1000, 100-period simulated conditional variance paths from

Mdl and specifies the numeric vector of presample

conditional variances v0 to initialize each returned

path.

To produce a conditional simulation, specify response data in the simulation

horizon by using the YF name-value argument.

Tbl = simulate(Mdl,numobs,Presample=Presample,Name=Value)Tbl containing the random

conditional variance and response series, which results from simulating the

model Mdl. simulate uses the table

or timetable of innovations or conditional variance presample data

Presample to initialize the model. If you specify

Presample, you must specify the variable containing the

presample innovation or conditional variance data by using the

PresampleInnovationVariable or

PresampleVarianceVariable name-value argument.

Examples

Simulate conditional variance and response paths from a GARCH(1,1) model. Return results in numeric matrices.

Specify a GARCH(1,1) model with known parameters.

Mdl = garch(Constant=0.01,GARCH=0.7,ARCH=0.2);

Simulate 500 sample paths, each with 100 observations.

rng("default") % For reproducibility [V,Y] = simulate(Mdl,100,NumPaths=500);

V and Y are 100-by-500 matrices of 500 simulated paths of conditional variances and responses, respectively.

figure tiledlayout(2,1) nexttile plot(V) title("Simulated Conditional Variances") nexttile plot(Y) title("Simulated Responses")

The simulated responses look like draws from a stationary stochastic process.

Plot the 2.5th, 50th (median), and 97.5th percentiles of the simulated conditional variances.

lower = prctile(V,2.5,2); middle = median(V,2); upper = prctile(V,97.5,2); figure plot(1:100,lower,"r:",1:100,middle,"k", ... 1:100,upper,"r:",LineWidth=2) legend("95% Confidence interval","Median") title("Approximate 95% Intervals")

The intervals are asymmetric due to positivity constraints on the conditional variance.

Simulate conditional variance and response paths from an EGARCH(1,1) model.

Specify an EGARCH(1,1) model with known parameters.

Mdl = egarch(Constant=0.001,GARCH=0.7,ARCH=0.2, ...

Leverage=-0.3);Simulate 500 sample paths, each with 100 observations.

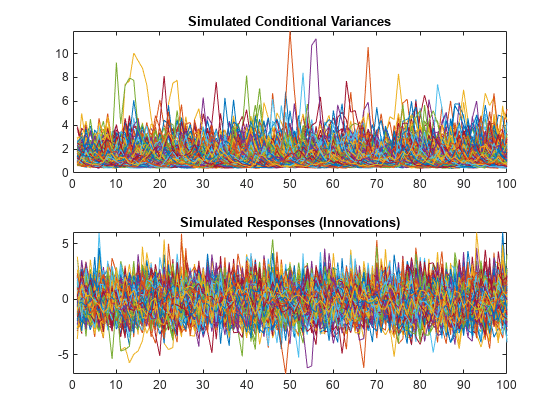

rng("default") % For reproducibility [V,Y] = simulate(Mdl,100,NumPaths=500); figure tiledlayout(2,1) nexttile plot(V) title("Simulated Conditional Variances") nexttile plot(Y) title("Simulated Responses (Innovations)")

The simulated responses look like draws from a stationary stochastic process.

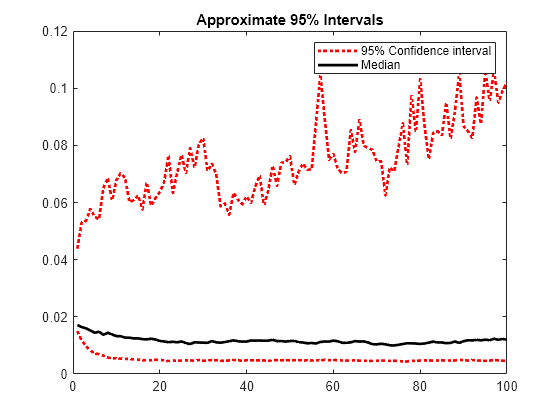

Plot the 2.5th, 50th (median), and 97.5th percentiles of the simulated conditional variances.

lower = prctile(V,2.5,2); middle = median(V,2); upper = prctile(V,97.5,2); figure plot(1:100,lower,"r:",1:100,middle,"k", ... 1:100, upper,"r:",LineWidth=2) legend("95% Confidence interval","Median") title("Approximate 95% Intervals")

The intervals are asymmetric due to positivity constraints on the conditional variance.

Simulate conditional variance and response paths from a GJR(1,1) model.

Specify a GJR(1,1) model with known parameters.

Mdl = gjr(Constant=0.001,GARCH=0.7,ARCH=0.2, ...

Leverage=0.1);Simulate 500 sample paths, each with 100 observations.

rng("default") % For reproducibility [V,Y] = simulate(Mdl,100,NumPaths=500); figure tiledlayout(2,1) nexttile plot(V) title("Simulated Conditional Variances") nexttile plot(Y) title("Simulated Responses (Innovations)")

The simulated responses look like draws from a stationary stochastic process.

Plot the 2.5th, 50th (median), and 97.5th percentiles of the simulated conditional variances.

lower = prctile(V,2.5,2); middle = median(V,2); upper = prctile(V,97.5,2); figure plot(1:100,lower,"r:",1:100,middle,"k", ... 1:100, upper,"r:",LineWidth=2) legend("95% Confidence interval","Median") title("Approximate 95% Intervals")

The intervals are asymmetric due to positivity constraints on the conditional variance.

Since R2023a

Simulate conditional variances of the average weekly closing NASDAQ returns for 100 weeks. Use the simulations to make forecasts and approximate 95% forecast intervals. Compare the forecasts among GARCH(1,1), EGARCH(1,1), and GJR(1,1) fits. Supply timetables of presample data.

Load the U.S. equity indices data Data_EquityIdx.mat.

load Data_EquityIdxThe timetable DataTimeTable contains the daily NASDAQ closing prices, among other indices.

Compute the weekly average closing prices of all timetable variables.

DTTW = convert2weekly(DataTimeTable,Aggregation="mean");Compute the weekly returns.

DTTRet = price2ret(DTTW); DTTRet.Interval = []; T = height(DTTRet)

T = 626

When you plan to supply a timetable, you must ensure it has all the following characteristics:

The selected response variable is numeric and does not contain any missing values.

The timestamps in the

Timevariable are regular, and they are ascending or descending.

Remove all missing values from the timetable, relative to the NASDAQ returns series.

DTTRet = rmmissing(DTTRet,DataVariables="NASDAQ");

numobs = height(DTTRet)numobs = 626

Because all sample times have observed NASDAQ returns, rmmissing does not remove any observations.

Determine whether the sampling timestamps have a regular frequency and are sorted.

areTimestampsRegular = isregular(DTTRet,"weeks")areTimestampsRegular = logical

1

areTimestampsSorted = issorted(DTTRet.Time)

areTimestampsSorted = logical

1

areTimestampsRegular = 1 indicates that the timestamps of DTTRet represent a regular weekly sample. areTimestampsSorted = 1 indicates that the timestamps are sorted.

Fit GARCH(1,1), EGARCH(1,1), and GJR(1,1) models to the entire data set.

Mdl = cell(3,1); % Preallocation Mdl{1} = garch(1,1); Mdl{2} = egarch(1,1); Mdl{3} = gjr(1,1); EstMdl = cellfun(@(x)estimate(x,DTTRet,ResponseVariable="NASDAQ", ... Display="off"),Mdl,UniformOutput=false);

EstMdl is 3-by-1 cell vector. Each cell is a different type of estimated conditional variance model, e.g., EstMdl{1} is an estimated GARCH(1,1) model.

Simulate 1000 samples paths with 100 observations each. Infer conditional variances and residuals to use as a presample for the forecast simulation.

T0 = 100; DTTSim = cell(3,1); % Preallocation PS = cell(3,1); for j = 1:3 rng("default") % For reproducibility PS{j} = infer(EstMdl{j},DTTRet,ResponseVariable="NASDAQ"); DTTSim{j} = simulate(EstMdl{j},T0,NumPaths=1000, ... Presample=PS{j},PresampleInnovationVariable="Y_Residual", ... PresampleVarianceVariable="Y_Variance"); end

DTTSim is a 3-by-1 cell vector, and each cell contains a 100-by-2 timetable of 1000 simulated paths of conditional variances and responses generated from the corresponding estimated model.

Plot the simulation mean forecasts and approximate 95% forecast intervals, along with the conditional variances inferred from the data.

lower = cellfun(@(x)prctile(x.Y_Variance,2.5,2),DTTSim,UniformOutput=false); upper = cellfun(@(x)prctile(x.Y_Variance,97.5,2),DTTSim,UniformOutput=false); mn = cellfun(@(x)mean(x.Y_Variance,2),DTTSim,UniformOutput=false); datesPlot = DTTRet.Time(end - 50:end); datesFH = DTTRet.Time(end) + caldays(1:100)'; h = zeros(3,4); figure for j = 1:3 col = zeros(1,3); col(j) = 1; h(j,1) = plot(datesPlot,PS{j}.Y_Variance(end-50:end),Color=col); hold on h(j,2) = plot(datesFH,mn{j},Color=col,LineWidth=3); h(j,3:4) = plot([datesFH datesFH],[lower{j} upper{j}],":", ... Color=col,LineWidth=2); end hGCA = gca; plot(datesFH([1 1]),hGCA.YLim,"k--"); axis tight; h = h(:,1:3); legend(h(:),'GARCH - Inferred','EGARCH - Inferred','GJR - Inferred',... 'GARCH - Sim. Mean','EGARCH - Sim. Mean','GJR - Sim. Mean',... 'GARCH - 95% Fore. Int.','EGARCH - 95% Fore. Int.',... 'GJR - 95% Fore. Int.','Location','NorthEast') title('Simulated Conditional Variance Forecasts') hold off

Input Arguments

Sample path length, specified as a positive integer. numobs is the number of random observations to generate per output path.

Data Types: double

Since R2023a

Presample data for innovations

εt or conditional variances

σt2

to initialize the model, specified as a table or timetable with

numprevars variables and numpreobs

rows.

simulate returns the simulated variables in the

output table or timetable Tbl, which is commensurate

with Presample.

Each selected variable is a single path (numpreobs-by-1

vector) or multiple paths

(numpreobs-by-numprepaths matrix)

of numpreobs observations representing the presample of

numpreobs observations of innovations or conditional

variances.

Each row is a presample observation, and measurements in each row occur

simultaneously. The last row contains the latest presample observation.

numpreobs must be one of the following values:

Mdl.QwhenPresampleprovides only presample innovations.For GARCH(P,Q) and GJR(P,Q) models:

Mdl.PwhenPresampleprovides only presample conditional variances.max([Mdl.P Mdl.Q])whenPresampleprovides both presample innovations and conditional variances

For EGARCH(P,Q) models,

max([Mdl.P Mdl.Q])whenPresampleprovides presample conditional variances

If numpreobs exceeds the minimum number,

simulate uses the latest required number of

observations only.

If numprepaths > NumPaths,

simulate uses only the first

NumPaths columns.

If Presample is a timetable, all the following

conditions must be true:

Presamplemust represent a sample with a regular datetime time step (seeisregular).The datetime vector of sample timestamps

Presample.Timemust be ascending or descending.

If Presample is a table, the last row contains the

latest presample observation.

The defaults are:

For GARCH(P,Q) and GJR(P,Q) models,

simulatesets any necessary presample innovations to the square root of the average squared value of the offset-adjusted response seriesY.For EGARCH(P,Q) models,

simulatesets any necessary presample innovations to zero.simulatesets any necessary presample conditional variances to the unconditional variance of the process.

If you specify the Presample, you must specify the

presample innovation or conditional variance variable names by using the

PresampleInnovationVariable or

PresampleVarianceVariable name-value

argument.

Name-Value Arguments

Specify optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where Name is

the argument name and Value is the corresponding value.

Name-value arguments must appear after other arguments, but the order of the

pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

Example: simulate(Mdl,100,NumPaths=1000,E0=[0.5; 0.5]) specifies

generating 1000 sample paths of length 100 from the model

Mdl, and using [0.5; 0.5] as the presample

of innovations per path.

Number of sample paths to generate, specified as a positive integer.

Example: NumPaths=1000

Data Types: double

Presample innovation paths

εt, specified as a

numpreobs-by-1 numeric column vector or a

numpreobs-by-numprepaths

matrix. Use E0 only when you supply optional data

inputs as numeric arrays.

The presample innovations provide initial values for the innovations

process of the conditional variance model Mdl. The

presample innovations derive from a distribution with mean 0.

numpreobs is the number of presample observations.

numprepaths is the number of presample

paths.

Each row is a presample observation, and measurements in each row

occur simultaneously. The last row contains the latest presample

observation. numpreobs must be at least

Mdl.Q. If numpreobs >

Mdl.Q, simulate uses the

latest required number of observations only. The last element or row

contains the latest observation.

If

E0is a column vector, it represents a single path of the underlying innovation series.simulateapplies it to each output path.If

E0is a matrix, each column represents a presample path of the underlying innovation series.numprepathsmust be at leastNumPaths. Ifnumprepaths>NumPaths,simulateuses the firstNumPathscolumns only.

The defaults are:

For GARCH(P,Q) and GJR(P,Q) models,

simulatesets any necessary presample innovations to an independent sequence of disturbances with mean zero and standard deviation equal to the unconditional standard deviation of the conditional variance process.For EGARCH(P,Q) models,

simulatesets any necessary presample innovations to an independent sequence of disturbances with mean zero and variance equal to the exponentiated unconditional mean of the logarithm of the EGARCH variance process.

Example: E0=[0.5; 0.5]

Positive presample conditional variance paths, specified as a

numpreobs-by-1 positive column vector or

numpreobs-by-numprepaths

positive matrix.. V0 provides initial values for the

conditional variances in the model. Use V0 only when

you supply optional data inputs as numeric arrays.

Each row is a presample observation, and measurements in each row occur simultaneously. The last row contains the latest presample observation.

For GARCH(P,Q) and GJR(P,Q) models,

numpreobsmust be at leastMdl.P.For EGARCH(P,Q) models,

numpreobsmust be at leastmax([Mdl.P Mdl.Q]).

If numpreobs exceeds the minimum

number, simulate uses only the latest

observations. The last element or row contains the latest

observation.

If

V0is a column vector, it represents a single path of the conditional variance series.simulateapplies it to each output path.If

V0is a matrix, each column represents a presample path of the conditional variance series.numprepathsmust be at leastNumPaths. Ifnumprepaths>NumPaths,simulateuses the firstNumPathscolumns only.

The defaults are:

For GARCH(P,Q) and GJR(P,Q) models,

simulatesets any necessary presample variances to the unconditional variance of the conditional variance process.For EGARCH(P,Q) models,

simulatesets any necessary presample variances to the exponentiated unconditional mean of the logarithm of the EGARCH variance process.

Example: V0=[1; 0.5]

Data Types: double

Since R2023a

Variable of Presample containing presample innovation paths εt, specified as one of the following data types:

String scalar or character vector containing a variable name in

Presample.Properties.VariableNamesVariable index (integer) to select from

Presample.Properties.VariableNamesA length

numprevarslogical vector, wherePresampleInnovationVariable(selects variablej) = truejPresample.Properties.VariableNames, andsum(PresampleInnovationVariable)is1

The selected variable must be a numeric matrix and cannot contain missing values (NaN).

If you specify presample innovation data by using the Presample name-value argument, you must specify PresampleInnovationVariable.

Example: PresampleInnovationVariable="StockRateInnov0"

Example: PresampleInnovationVariable=[false false true false] or PresampleInnovationVariable=3 selects the third table variable as the presample innovation variable.

Data Types: double | logical | char | cell | string

Since R2023a

Variable of Presample containing data for the presample conditional

variances

σt2,

specified as one of the following data types:

String scalar or character vector containing a variable name in

Presample.Properties.VariableNamesVariable index (positive integer) to select from

Presample.Properties.VariableNamesA logical vector, where

PresampleVarianceVariable(selects variablej) = truejPresample.Properties.VariableNames

The selected variable must be a numeric vector and cannot contain missing values

(NaNs).

If you specify presample conditional variance data by using the Presample name-value argument, you must specify PresampleVarianceVariable.

Example: PresampleVarianceVariable="StockRateVar0"

Example: PresampleVarianceVariable=[false false true false] or PresampleVarianceVariable=3 selects the third table variable as the presample conditional variance variable.

Data Types: double | logical | char | cell | string

Notes

NaNvalues inE0, andV0indicate missing values.simulateremoves missing values from specified data by list-wise deletion.simulatehorizontally concatenatesE0andV0, and then it removes any row of the concatenated matrix containing at least oneNaN. This type of data reduction reduces the effective sample size and can create an irregular time series.For numeric data inputs,

simulateassumes that you synchronize the presample data such that the latest observations occur simultaneously.simulateissues an error when any table or timetable input contains missing values.If

E0andV0are column vectors,simulateapplies them to every column of the outputsVandY. This application allows simulated paths to share a common starting point for Monte Carlo simulation of forecasts and forecast error distributions.

Output Arguments

Simulated conditional variance paths

σt2

of the mean-zero innovations associated with Y,

returned as a numobs-by-1 numeric column vector or

numobs-by-NumPaths matrix.

simulate returns V when you

do not specify the input table or timetable

Presample.

Each column of V corresponds to a simulated

conditional variance path. Rows of V are periods

corresponding to the periodicity of Mdl.

Simulated response paths yt,

returned as a numobs-by-1 numeric column vector or

numobs-by-NumPaths matrix.

simulate returns Y when you

do not specify the input table or timetable

Presample.

Y usually represents a mean-zero, heteroscedastic time

series of innovations with conditional variances given in

V (a continuation of the presample innovation

series E0).

Y can also represent a time series of mean-zero,

heteroscedastic innovations plus an offset. If Mdl

includes an offset, then simulate adds the offset to

the underlying mean-zero, heteroscedastic innovations so that

Y represents a time series of offset-adjusted

innovations.

Each column of Y corresponds to a simulated response

path. Rows of Y are periods corresponding to the

periodicity of Mdl.

Since R2023a

Simulated conditional variance

σt2

and response yt paths, returned as

a table or timetable, the same data type as Presample.

simulate returns Tbl only

when you supply the input Presample.

Tbl contains the following variables:

The simulated conditional variance paths, which are in a

numobs-by-NumPathsnumeric matrix, with rows representing observations and columns representing independent paths. Each path represents the continuation of the corresponding path of presample conditional variances inPresample.simulatenames the simulated conditional variance variable inTblresponseName_VarianceresponseNameMdl.SeriesName. For example, ifMdl.SeriesNameisStockReturns,Tblcontains a variable for the corresponding simulated conditional variance paths with the nameStockReturns_Variance.The simulated response paths, which are in a

numobs-by-NumPathsnumeric matrix, with rows representing observations and columns representing independent paths. Each path represents the continuation of the corresponding presample innovations path inPresample.simulatenames the simulated response variable inTblresponseName_ResponseresponseNameMdl.SeriesName. For example, ifMdl.SeriesNameisStockReturns,Tblcontains a variable for the corresponding simulated response paths with the nameStockReturns_Response.

If Tbl is a timetable, the following conditions hold:

The row order of

Tbl, either ascending or descending, matches the row order ofPreample.Tbl.Time(1)is the next time afterPresample(end)relative the sampling frequency, andTbl.Time(2:numobs)are the following times relative to the sampling frequency.

References

[1] Bollerslev, T. “Generalized Autoregressive Conditional Heteroskedasticity.” Journal of Econometrics. Vol. 31, 1986, pp. 307–327.

[2] Bollerslev, T. “A Conditionally Heteroskedastic Time Series Model for Speculative Prices and Rates of Return.” The Review of Economics and Statistics. Vol. 69, 1987, pp. 542–547.

[3] Box, G. E. P., G. M. Jenkins, and G. C. Reinsel. Time Series Analysis: Forecasting and Control. 3rd ed. Englewood Cliffs, NJ: Prentice Hall, 1994.

[4] Enders, W. Applied Econometric Time Series. Hoboken, NJ: John Wiley & Sons, 1995.

[5] Engle, R. F. “Autoregressive Conditional Heteroskedasticity with Estimates of the Variance of United Kingdom Inflation.” Econometrica. Vol. 50, 1982, pp. 987–1007.

[6] Glosten, L. R., R. Jagannathan, and D. E. Runkle. “On the Relation between the Expected Value and the Volatility of the Nominal Excess Return on Stocks.” The Journal of Finance. Vol. 48, No. 5, 1993, pp. 1779–1801.

[7] Hamilton, J. D. Time Series Analysis. Princeton, NJ: Princeton University Press, 1994.

[8] Nelson, D. B. “Conditional Heteroskedasticity in Asset Returns: A New Approach.” Econometrica. Vol. 59, 1991, pp. 347–370.

Version History

Introduced in R2012aIn addition to accepting presample data in numeric arrays,

simulate accepts presample data in tables or regular

timetables. When you supply data in a table or timetable, the following conditions

apply:

If you specify optional presample innovation or conditional variance data to initialize the model, you must also specify the presample innovation or conditional variance series name.

simulatereturns results in a table or timetable.

Name-value arguments to support tabular workflows include:

Presamplespecifies the input table or regular timetable of presample innovations and conditional variance data.PresampleInnovationVariablespecifies the variable name of the innovation paths to select fromPresample.PresampleVarianceVariablespecifies the variable name of the conditional variance paths to select fromPresample.

See Also

Objects

Functions

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

选择网站

选择网站以获取翻译的可用内容,以及查看当地活动和优惠。根据您的位置,我们建议您选择:。

您也可以从以下列表中选择网站:

如何获得最佳网站性能

选择中国网站(中文或英文)以获得最佳网站性能。其他 MathWorks 国家/地区网站并未针对您所在位置的访问进行优化。

美洲

- América Latina (Español)

- Canada (English)

- United States (English)

欧洲

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)