Value-at-Risk Estimation and Backtesting

This example shows how to estimate the value-at-risk (VaR) using three methods and perform a VaR backtesting analysis. The three methods are:

Normal distribution

Historical simulation

Exponential weighted moving average (EWMA)

Value-at-risk is a statistical method that quantifies the risk level associated with a portfolio. The VaR measures the maximum amount of loss over a specified time horizon and at a given confidence level.

Backtesting measures the accuracy of the VaR calculations. Using VaR methods, the loss forecast is calculated and then compared to the actual losses at the end of the next day. The degree of difference between the predicted and actual losses indicates whether the VaR model is underestimating or overestimating risk. As such, backtesting looks retrospectively at data and helps to assess the VaR model.

The three estimation methods used in this example estimate the VaR at 95% and 99% confidence levels.

Load the Data and Define the Test Window

Load the data. The data used in this example is from a time series of returns on the S&P index from 1993 through 2003.

load VaRExampleData.mat

Returns = tick2ret(sp);

DateReturns = dates(2:end);

SampleSize = length(Returns);Define the estimation window as 250 trading days. The test window starts on the first day in 1996 and runs through the end of the sample.

TestWindowStart = find(year(DateReturns)==1996,1); TestWindow = TestWindowStart : SampleSize; EstimationWindowSize = 250;

For a VaR confidence level of 95% and 99%, set the VaR Level to .95 and .99.

VaRLevel = [0.95 0.99];

These values mean that there is a 5% and 1% probability, respectively, that the loss incurred will be greater than the maximum threshold (that is, greater than the VaR).

Compute the VaR Using the Normal Distribution Method

For the normal distribution method, assume that the profit and loss of the portfolio is normally distributed. Using this assumption, compute the VaR using the valueAtRisk function in the Risk Management Toolbox™. valueAtRisk will need the distribution type (normal), as well as the mean (assumed 0) and standard deviation of the returns. Because VaR backtesting looks retrospectively at data, the VaR "today" is computed based on values of the returns in the last N = 250 days leading up to, but not including, "today."

Normal95 = zeros(length(TestWindow),1); Normal99 = zeros(length(TestWindow),1); for t = TestWindow i = t - TestWindowStart + 1; EstimationWindow = t-EstimationWindowSize:t-1; Sigma = std(Returns(EstimationWindow)); VaRs = valueAtRisk("normal",VaRLevel,"Mean",0,"StandardDeviation",Sigma); Normal95(i) = VaRs(1); Normal99(i) = VaRs(2); end figure; plot(DateReturns(TestWindow),[Normal95 Normal99]) xlabel('Date') ylabel('VaR') legend({'95% Confidence Level','99% Confidence Level'},'Location','Best') title('VaR Estimation Using the Normal Distribution Method')

The normal distribution method is also known as parametric VaR because its estimation involves computing a parameter for the standard deviation of the returns. The advantage of the normal distribution method is its simplicity. However, the weakness of the normal distribution method is the assumption that returns are normally distributed. Another name for the normal distribution method is the variance-covariance approach.

Compute the VaR Using the Historical Simulation Method

Unlike the normal distribution method, the historical simulation (HS) method is nonparametric. It does not assume a particular distribution of the asset returns. Historical simulation forecasts risk by assuming that past profits and losses can be used as the distribution of profits and losses for the next period of returns. The VaR "today" can be thought of as the p th-quantile of the last N returns prior to "today," where p = 1-VaRLevel. Once again we can calculate the VaR using valueAtRisk.

Historical95 = zeros(length(TestWindow),1); Historical99 = zeros(length(TestWindow),1); for t = TestWindow i = t - TestWindowStart + 1; EstimationWindow = t-EstimationWindowSize:t-1; X = Returns(EstimationWindow); VaRs = valueAtRisk("empirical",VaRLevel,"InputData",X'); Historical95(i) = VaRs(1); Historical99(i) = VaRs(2); end figure; plot(DateReturns(TestWindow),[Historical95 Historical99]) ylabel('VaR') xlabel('Date') legend({'95% Confidence Level','99% Confidence Level'},'Location','Best') title('VaR Estimation Using the Historical Simulation Method')

The preceding figure shows that the historical simulation curve has a piecewise constant profile. The reason for this is that quantiles do not change for several days until extreme events occur. Thus, the historical simulation method is slow to react to changes in volatility.

Compute the VaR Using the Exponentially Weighted Moving Average Method (EWMA)

The first two VaR methods assume that all past returns carry the same weight. The exponential weighted moving average (EWMA) method, however, uses exponentially decreasing weights. The most recent returns have higher weights because they influence "today's" return more heavily than returns further in the past. The formula for the EWMA variance over an estimation window of size is:

where is a normalizing constant:

For convenience, we assume an infinitely large estimation window to approximate the variance:

A value of the decay factor frequently used in practice is 0.94. This is the value used in this example. For more information, see References.

Initiate the EWMA using a warm-up phase to set up the standard deviation.

Lambda = 0.94; Sigma2 = zeros(length(Returns),1); Sigma2(1) = Returns(1)^2; for i = 2 : (TestWindowStart-1) Sigma2(i) = (1-Lambda) * Returns(i-1)^2 + Lambda * Sigma2(i-1); end

Use the EWMA in the test window to estimate the VaR.

EWMA95 = zeros(length(TestWindow),1); EWMA99 = zeros(length(TestWindow),1); for t = TestWindow k = t - TestWindowStart + 1; Sigma2(t) = (1-Lambda) * Returns(t-1)^2 + Lambda * Sigma2(t-1); Sigma = sqrt(Sigma2(t)); VaRs = valueAtRisk("normal",VaRLevel,"Mean",0,"StandardDeviation",Sigma); EWMA95(k) = VaRs(1); EWMA99(k) = VaRs(2); end figure; plot(DateReturns(TestWindow),[EWMA95 EWMA99]) ylabel('VaR') xlabel('Date') legend({'95% Confidence Level','99% Confidence Level'},'Location','Best') title('VaR Estimation Using the EWMA Method')

In the preceding figure, the EWMA reacts very quickly to periods of large (or small) returns.

VaR Backtesting

The goal of VaR backtesting is to evaluate the performance of VaR models. A VaR estimate with a 95% confidence level should only be violated about 5% of the time, and VaR failures should not cluster. Clustering of VaR failures indicates a lack of independence across time, indicating that the VaR models are slow to react to changing market conditions.

In the Risk Management Toolbox, the varbacktest object supports multiple statistical tests for VaR backtesting analysis, as well as other helpful functionality. For example, a common first step in VaR backtesting analysis is to plot the returns and the VaR estimates together. You can plot all three methods at the 95% confidence level and compare them to the returns using the varbacktest 'plot' command.

ReturnsTest = Returns(TestWindow); DatesTest = DateReturns(TestWindow); figure vbt = varbacktest(ReturnsTest,[Normal95 Historical95 EWMA95],'PortfolioID','S&P','VaRID',... {'Normal95','Historical95','EWMA95'},'VaRLevel',0.95,'Time',DatesTest); plot(vbt)

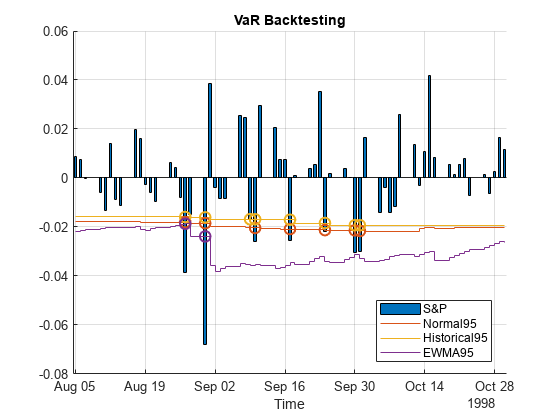

To highlight how the different approaches react differently to changing market conditions, you can zoom in on the time series where there is a large and sudden change in the value of returns. For example, around August 1998:

figure subvbt = select(vbt,"TimeRange",[datetime(1998,8,5),datetime(1998,10,31)]); plot(subvbt,'Type','bar');

A VaR failure or violation happens when the returns are below -1 times the VaR estimate. A closer look around August 27 to August 31 shows a significant dip in the returns. On the dates starting from August 27 onward, the EWMA follows the trend of the returns closely and more accurately. Consequently, EWMA has fewer VaR violations (two (2) violations, purple) compared to the Normal Distribution approach (seven (7) violations, red) or the Historical Simulation method (eight (8) violations, yellow).

Besides visual tools, you can use statistical tests for VaR backtesting. For example, you can use a varbacktest object to compare test results for the normal distribution approach at the 95% and 99% VaR levels.

vbt = varbacktest(ReturnsTest,[Normal95 Normal99],'PortfolioID','S&P','VaRID',... {'Normal95','Normal99'},'VaRLevel',[0.95 0.99]); summary(vbt)

ans=2×10 table

PortfolioID VaRID VaRLevel ObservedLevel Observations Failures Expected Ratio FirstFailure Missing

___________ __________ ________ _____________ ____________ ________ ________ ______ ____________ _______

"S&P" "Normal95" 0.95 0.94863 1966 101 98.3 1.0275 7 0

"S&P" "Normal99" 0.99 0.98372 1966 32 19.66 1.6277 7 0

The summary report shows that the observed level is close enough to the defined VaR level. The 95% and 99% VaR levels have at most (1-VaR_level) x N expected failures, where N is the number of observations. The failure ratio shows that the Normal95 VaR level is within range, whereas the Normal99 VaR Level is imprecise and under-forecasts the risk. To run all tests supported in varbacktest, use runtests.

runtests(vbt)

ans=2×11 table

PortfolioID VaRID VaRLevel TL Bin POF TUFF CC CCI TBF TBFI

___________ __________ ________ ______ ______ ______ ______ ______ ______ ______ ______

"S&P" "Normal95" 0.95 green accept accept accept accept reject reject reject

"S&P" "Normal99" 0.99 yellow reject reject accept reject accept reject reject

The 95% VaR passes the frequency tests, such as traffic light, binomial and proportion of failures tests (tl, bin, and pof columns). The 99% VaR does not pass these same tests, as indicated by the yellow and reject results. Both confidence levels got rejected in the conditional coverage independence, and time between failures independence tests (cci and tbfi columns). This result suggests that the VaR violations are not independent, and one failure increases the probability that other failures will follow in subsequent days. For more information on the test methodologies and interpretation of results, see varbacktest and the individual tests.

Using a varbacktest object, run the same tests on the portfolio for the three approaches at both VaR confidence levels.

vbt = varbacktest(ReturnsTest,[Normal95 Historical95 EWMA95 Normal99 Historical99 ... EWMA99],'PortfolioID','S&P','VaRID',{'Normal95','Historical95','EWMA95',... 'Normal99','Historical99','EWMA99'},'VaRLevel',[0.95 0.95 0.95 0.99 0.99 0.99]); runtests(vbt)

ans=6×11 table

PortfolioID VaRID VaRLevel TL Bin POF TUFF CC CCI TBF TBFI

___________ ______________ ________ ______ ______ ______ ______ ______ ______ ______ ______

"S&P" "Normal95" 0.95 green accept accept accept accept reject reject reject

"S&P" "Historical95" 0.95 yellow accept accept accept accept accept reject reject

"S&P" "EWMA95" 0.95 green accept accept accept accept accept reject reject

"S&P" "Normal99" 0.99 yellow reject reject accept reject accept reject reject

"S&P" "Historical99" 0.99 yellow reject reject accept reject accept reject reject

"S&P" "EWMA99" 0.99 red reject reject accept reject accept reject reject

The results are similar to the previous results. At the 95% level, the frequency results are largely acceptable, while the frequency results at the 99% level are generally rejections. Regarding independence, most tests pass the conditional coverage independence test (cci), which tests for independence on consecutive days. Notice, however, that all tests fail the time between failures independence test (tbfi), which takes into account the times between all failures. This result suggests that all methods have issues with the independence assumption.

To better understand how these results change given market conditions, look at the years 2000 and 2002 for the 95% VaR confidence level.

Ind2000 = (year(DatesTest) == 2000); vbt2000 = select(vbt,"TimeRange",Ind2000,"VaRID",{'Normal95','Historical95','EWMA95'}); runtests(vbt2000)

ans=3×11 table

PortfolioID VaRID VaRLevel TL Bin POF TUFF CC CCI TBF TBFI

___________ ______________ ________ _____ ______ ______ ______ ______ ______ ______ ______

"S&P" "Normal95" 0.95 green accept accept accept accept accept accept accept

"S&P" "Historical95" 0.95 green accept accept accept accept accept accept accept

"S&P" "EWMA95" 0.95 green accept accept accept accept accept accept accept

Ind2002 = (year(DatesTest) == 2002); vbt2002 = select(vbt,"TimeRange",Ind2002,"VaRID",{'Normal95','Historical95','EWMA95'}); runtests(vbt2002)

ans=3×11 table

PortfolioID VaRID VaRLevel TL Bin POF TUFF CC CCI TBF TBFI

___________ ______________ ________ ______ ______ ______ ______ ______ ______ ______ ______

"S&P" "Normal95" 0.95 yellow reject reject accept reject reject reject reject

"S&P" "Historical95" 0.95 yellow reject accept accept reject reject reject reject

"S&P" "EWMA95" 0.95 green accept accept accept accept reject reject reject

For the year 2000, all three methods pass all the tests. However, for the year 2002, the test results are mostly rejections for all methods. The EWMA method seems to perform better in 2002, yet all methods fail the independence tests.

To get more insight into the independence tests, look into the conditional coverage independence (cci) and the time between failures independence (tbfi) test details for the year 2002. To access the test details for all tests, run the individual test functions.

cci(vbt2002)

ans=3×13 table

PortfolioID VaRID VaRLevel CCI LRatioCCI PValueCCI Observations Failures N00 N10 N01 N11 TestLevel

___________ ______________ ________ ______ _________ _________ ____________ ________ ___ ___ ___ ___ _________

"S&P" "Normal95" 0.95 reject 12.591 0.0003877 261 21 225 14 14 7 0.95

"S&P" "Historical95" 0.95 reject 6.3051 0.012039 261 20 225 15 15 5 0.95

"S&P" "EWMA95" 0.95 reject 4.6253 0.031504 261 14 235 11 11 3 0.95

In the CCI test, the probability of having a failure at time t, knowing that there was no failure at time t-1 is given by

The probability of having a failure at time t, knowing that there was a failure at time t-1 is given by

From the N00, N10, N01, N11 columns in the test results, the value of is around 5% for the three methods, yet the values of are above 20%. Because there is evidence that a failure is followed by another failure much more frequently than 5% of the time, this CCI test fails.

In the time between failures independence test, look at the minimum, maximum, and quartiles of the distribution of times between failures, in the columns TBFMin, TBFQ1, TBFQ2, TBFQ3, TBFMax.

tbfi(vbt2002)

ans=3×14 table

PortfolioID VaRID VaRLevel TBFI LRatioTBFI PValueTBFI Observations Failures TBFMin TBFQ1 TBFQ2 TBFQ3 TBFMax TestLevel

___________ ______________ ________ ______ __________ __________ ____________ ________ ______ _____ _____ _____ ______ _________

"S&P" "Normal95" 0.95 reject 53.936 0.00010087 261 21 1 1 5 17 48 0.95

"S&P" "Historical95" 0.95 reject 45.274 0.0010127 261 20 1 1.5 5.5 17 48 0.95

"S&P" "EWMA95" 0.95 reject 25.756 0.027796 261 14 1 4 7.5 20 48 0.95

For a VaR level of 95%, you expect an average time between failures of 20 days, or one failure every 20 days. However, the median of the time between failures for the year 2002 ranges between 5 and 7.5 for the three methods. This result suggests that half of the time, two consecutive failures occur within 5 to 7 days, much more frequently than the 20 expected days. For the normal method, the first quartile is 1, meaning that 25% of the failures occur on consecutive days.

References

Nieppola, O. Backtesting Value-at-Risk Models. Helsinki School of Economics. 2009.

Danielsson, J. Financial Risk Forecasting: The Theory and Practice of Forecasting Market Risk, with Implementation in R and MATLAB®. Wiley Finance, 2012.

See Also

varbacktest | tl | bin | pof | tuff | cc | cci | tbf | tbfi | summary | runtests | select | plot | exceptions | append