forecast

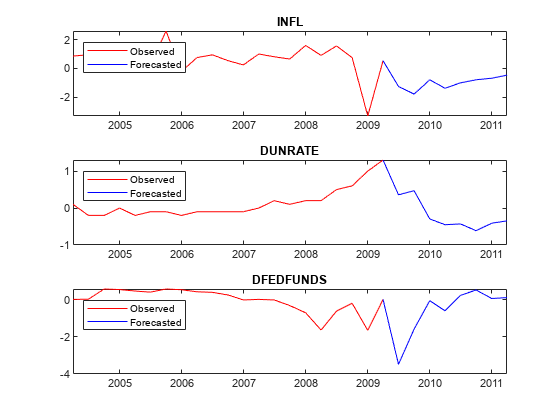

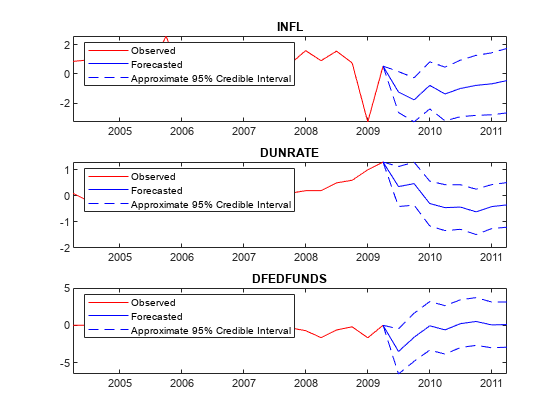

Forecast responses from Bayesian vector autoregression (VAR) model

Description

forecast is well suited for computing out-of-sample unconditional forecasts of a Bayesian VAR(p) model that does not contain an exogenous regression component. For advanced applications, such as out-of-sample conditional forecasting, VARX(p) model forecasting, missing value imputation, and Gibbs sampler specification for posterior predictive distribution estimation, see simsmooth.

YF = forecast(PriorMdl,numperiods,Y)YF over the length numperiods forecast horizon. Each period in YF is the mean of the posterior predictive distribution, which is derived from the posterior distribution of the prior Bayesian VAR(p) model

PriorMdl given the response data Y. The output YF represents the continuation of Y.

NaNs in the data indicate missing values, which forecast removes using list-wise deletion.

Examples

Input Arguments

Output Arguments

More About

Tips

Monte Carlo simulation is subject to variation. If

forecastuses Monte Carlo simulation, then estimates and inferences might vary when you callforecastmultiple times under seemingly equivalent conditions. To reproduce estimation results, set a random number seed by usingrngbefore callingforecast.

Algorithms

If the posterior predictive distribution is analytically intractable (true for most cases),

forecastimplements Markov Chain Monte Carlo (MCMC) sampling with Bayesian data augmentation to compute the mean and standard deviation of the posterior predictive distribution. To do so,forecastcallssimsmooth, which uses a computationally intensive procedure.Most Econometrics Toolbox™

forecastfunctions accept an estimated or posterior model object from which to generate forecasts. Such a model encompasses the parametric structure and data. However, theforecastfunction of Bayesian VAR models requires presample and estimation sample data to do the following:Perform Bayesian parameter updating to estimate posterior distributions.

forecastimplements MCMC sampling with Bayesian data augmentation, which includes a Kalman filter smoothing step that requires the entire observed series.Predict future responses in the presence of two sources of uncertainty:

Estimation noise ε1,…,εT, which induces parameter uncertainty

Forecast period noise εT+1,…,εT+

numperiods

References

[1] Litterman, Robert B. "Forecasting with Bayesian Vector Autoregressions: Five Years of Experience." Journal of Business and Economic Statistics 4, no. 1 (January 1986): 25–38. https://doi.org/10.2307/1391384.

Version History

Introduced in R2020a