Consider a VEC model for the following seven macroeconomic series.

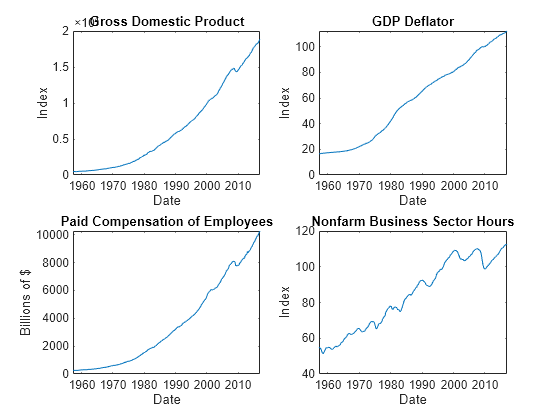

Gross domestic product (GDP)

GDP implicit price deflator

Paid compensation of employees

Nonfarm business sector hours of all persons

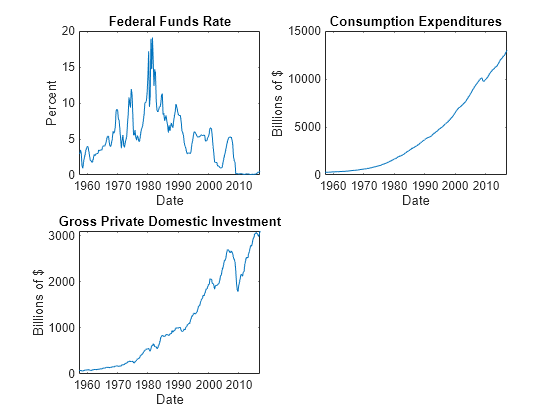

Effective federal funds rate

Personal consumption expenditures

Gross private domestic investment

Suppose that a cointegrating rank of 4 and one short-run term are appropriate, that is, consider a VEC(1) model.

Load the Data_USEconVECModel data set.

For more information on the data set and variables, enter Description at the command line.

Determine whether the data needs to be preprocessed by plotting the series on separate plots.

Stabilize all series, except the federal funds rate, by applying the log transform. Scale the resulting series by 100 so that all series are on the same scale.

Create a VEC(1) model using the shorthand syntax. Specify the variable names.

Mdl =

vecm with properties:

Description: "7-Dimensional Rank = 4 VEC(1) Model with Linear Time Trend"

SeriesNames: "GDP" "GDPDEF" "COE" ... and 4 more

NumSeries: 7

Rank: 4

P: 2

Constant: [7×1 vector of NaNs]

Adjustment: [7×4 matrix of NaNs]

Cointegration: [7×4 matrix of NaNs]

Impact: [7×7 matrix of NaNs]

CointegrationConstant: [4×1 vector of NaNs]

CointegrationTrend: [4×1 vector of NaNs]

ShortRun: {7×7 matrix of NaNs} at lag [1]

Trend: [7×1 vector of NaNs]

Beta: [7×0 matrix]

Covariance: [7×7 matrix of NaNs]

Mdl is a vecm model object. All properties containing NaN values correspond to parameters to be estimated given data.

Estimate the model using the entire data set and the default options.

EstMdl =

vecm with properties:

Description: "7-Dimensional Rank = 4 VEC(1) Model"

SeriesNames: "GDP" "GDPDEF" "COE" ... and 4 more

NumSeries: 7

Rank: 4

P: 2

Constant: [14.1329 8.77841 -7.20359 ... and 4 more]'

Adjustment: [7×4 matrix]

Cointegration: [7×4 matrix]

Impact: [7×7 matrix]

CointegrationConstant: [-28.6082 -109.555 77.0912 ... and 1 more]'

CointegrationTrend: [4×1 vector of zeros]

ShortRun: {7×7 matrix} at lag [1]

Trend: [7×1 vector of zeros]

Beta: [7×0 matrix]

Covariance: [7×7 matrix]

EstMdl is an estimated vecm model object. It is fully specified because all parameters have known values. By default, estimate imposes the constraints of the H1 Johansen VEC model form by removing the cointegrating trend and linear trend terms from the model. Parameter exclusion from estimation is equivalent to imposing equality constraints to zero.

Convert the estimated VEC(1) model to its equivalent VAR(2) model representation.

VARMdl =

varm with properties:

Description: "AR-Nonstationary 7-Dimensional VAR(2) Model"

SeriesNames: "GDP" "GDPDEF" "COE" ... and 4 more

NumSeries: 7

P: 2

Constant: [14.1329 8.77841 -7.20359 ... and 4 more]'

AR: {7×7 matrices} at lags [1 2]

Trend: [7×1 vector of zeros]

Beta: [7×0 matrix]

Covariance: [7×7 matrix]

VARMdl is a varm model object.