hwcalbycap

Calibrate Hull-White tree using caps

Syntax

Description

[

calibrates the Alpha,Sigma,OptimOut] = hwcalbycap(RateSpec,MarketStrikeMarketMaturity,MarketVolatility)Alpha (mean reversion) and Sigma

(volatility) using cap market data and the Hull-White model using the entire cap surface.

The Hull-White calibration functions (hwcalbycap and hwcalbyfloor) support three models: Black (default), Bachelier or Normal,

and Shifted Black. For more information, see the optional arguments for

Shift and Model.

[

estimates the Alpha,Sigma,OptimOut = hwcalbycap(RateSpec,MarketStrikeMarketMaturity,MarketVolatility,Strike,Settle,Maturity)Alpha (mean reversion) and Sigma

(volatility) using cap market data and the Hull-White model to price a cap at a particular

maturity/volatility using the additional optional input arguments for

Strike, Settle, and

Maturity.

Strike, Settle, and

Maturity arguments are specified to calibrate to a specific point

on the market volatility surface. If omitted, the calibration is performed across all the

market instruments

For an example of calibrating using the Hull-White model with

Strike, Settle, and Maturity

input arguments, see Calibrating Hull-White Model Using Market Data.

[

adds optional name-value pair arguments. Alpha,Sigma,OptimOut] = hwcalbycap(___,Name,Value)

Examples

This example shows how to use hwcalbycap input

arguments for MarketStrike, MarketMaturity, and

MarketVolatility to calibrate the HW model using the entire cap

volatility surface.

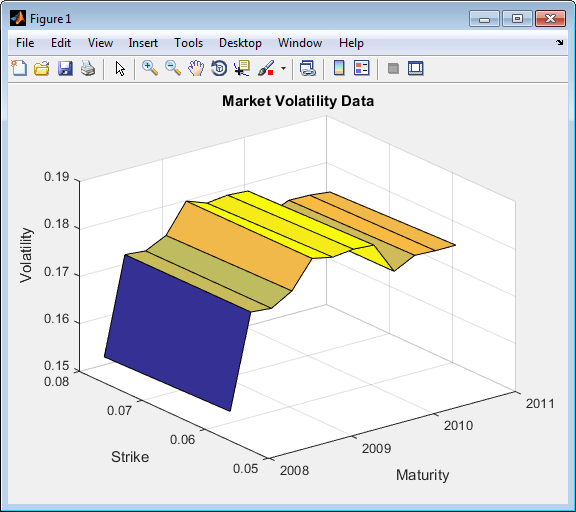

Cap market volatility data covering two strikes over 12 maturity dates.

Reset = 4; MarketStrike = [0.0590; 0.0790]; MarketMaturity = [datetime(2008,3,21) ; datetime(2008,6,21) ; datetime(2008,9,21) ; datetime(2008,12,21) ; ... datetime(2009,3,21) ; datetime(2009,6,21) ; datetime(2009,9,21) ; datetime(2009,12,21); datetime(2010,3,21) ; ... datetime(2010,6,21); datetime(2010,9,21) ; datetime(2010,12,21)]; MarketVolaltility = [0.1533 0.1731 0.1727 0.1752 0.1809 0.1800 0.1805 0.1802 ... 0.1735 0.1757 0.1755 0.1755; 0.1526 0.1730 0.1726 0.1747 0.1808 0.1792 0.1797 0.1794 ... 0.1733 0.1751 0.1750 0.1745];

Plot market volatility surface.

[AllMaturities,AllStrikes] = meshgrid(MarketMaturity,MarketStrike); figure; surf(AllMaturities,AllStrikes,MarketVolaltility) xlabel('Maturity') ylabel('Strike') zlabel('Volatility') title('Market Volatility Data')

Set interest rate term structure and create a RateSpec.

Settle = '21-Jan-2008'; Compounding = 4; Basis = 0; Rates= [0.0627; 0.0657; 0.0691; 0.0717; 0.0739; 0.0755; 0.0765; 0.0772; 0.0779; 0.0783; 0.0786; 0.0789]; EndDates = [datetime(2008,3,21) ; datetime(2008,6,21) ; datetime(2008,9,21) ; datetime(2008,12,21) ; ... datetime(2009,3,21) ; datetime(2009,6,21) ; datetime(2009,9,21) ; datetime(2009,12,21); datetime(2010,3,21) ; ... datetime(2010,6,21); datetime(2010,9,21) ; datetime(2010,12,21)]; RateSpec = intenvset('ValuationDate', Settle, 'StartDates', Settle, ... 'EndDates', EndDates,'Rates', Rates, 'Compounding', Compounding, ... 'Basis',Basis)

RateSpec =

FinObj: 'RateSpec'

Compounding: 4

Disc: [12x1 double]

Rates: [12x1 double]

EndTimes: [12x1 double]

StartTimes: [12x1 double]

EndDates: [12x1 double]

StartDates: 733428

ValuationDate: 733428

Basis: 0

EndMonthRule: 1Calibrate Hull-White model from market data.

o = optimoptions('lsqnonlin','TolFun',1e-5,'Display','off'); [Alpha, Sigma] = hwcalbycap(RateSpec, MarketStrike, MarketMaturity, ... MarketVolaltility, 'Reset', Reset,'Basis', Basis, 'OptimOptions', o)

Warning: LSQNONLIN did not converge to an optimal solution. It exited with exitflag = 3.

> In hwcalbycapfloor>optimizeOverCapSurface at 232

In hwcalbycapfloor at 79

In hwcalbycap at 81

Alpha =

0.0943

Sigma =

0.0146Compare with Black prices.

BlkPrices = capbyblk(RateSpec,AllStrikes(:), Settle, AllMaturities(:), ... MarketVolaltility(:),'Reset',Reset,'Basis',Basis);

BlkPrices =

0.0604

0

0.2729

0.0006

0.6498

0.0412

1.1121

0.1426

1.6426

0.3131

2.1869

0.4998

2.7056

0.6894

3.2124

0.8815

3.7311

1.0686

4.2246

1.2790

4.7027

1.4810

5.1877

1.6919Setup Hull-White tree using calibrated parameters, alpha, and sigma.

VolDates = EndDates; VolCurve = Sigma*ones(numel(EndDates),1); AlphaDates = EndDates; AlphaCurve = Alpha*ones(numel(EndDates),1); HWVolSpec = hwvolspec(Settle, VolDates, VolCurve, AlphaDates, AlphaCurve); HWTimeSpec = hwtimespec(Settle, EndDates, Compounding); HWTree = hwtree(HWVolSpec, RateSpec, HWTimeSpec, 'Method', 'HW2000')

HWTree =

FinObj: 'HWFwdTree'

VolSpec: [1x1 struct]

TimeSpec: [1x1 struct]

RateSpec: [1x1 struct]

tObs: [0 0.6593 1.6612 2.6593 3.6612 4.6593 5.6612 6.6593 7.6612 8.6593 9.6612 10.6593]

dObs: [733428 733488 733580 733672 733763 733853 733945 734037 734128 734218 734310 734402]

CFlowT: {1x12 cell}

Probs: {1x11 cell}

Connect: {1x11 cell}

FwdTree: {1x12 cell}Compute Hull-White prices based on the calibrated tree.

HWPrices = capbyhw(HWTree, AllStrikes(:), Settle, AllMaturities(:), Reset, Basis)

HWPrices =

0.0601

0

0.2788

0

0.6580

0.0518

1.1254

0.1485

1.6591

0.3123

2.2076

0.5022

2.7319

0.6883

3.2459

0.8774

3.7771

1.0900

4.2769

1.2875

4.7645

1.4845

5.2572

1.6921Plot Black prices against the calibrated Hull-White tree prices.

figure; plot(AllMaturities(:), BlkPrices, 'or', AllMaturities(:), HWPrices, '*b'); xtickformat; xlabel('Maturity'); ylabel('Price'); title('Black and Calibrated (HW) Prices'); legend('Black Price', 'Calibrated HW Tree Price','Location', 'NorthWest'); grid on

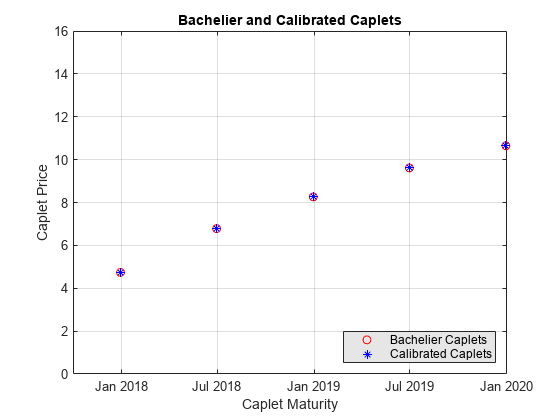

This example shows how to use hwcalbycap to calibrate market data with the Normal (Bachelier) model to price caplets. Use the Normal (Bachelier) model to perform calibrations when working with negative interest rates, strikes, and normal implied volatilities.

Consider a cap with these parameters:

Settle = datetime(2016,12,30); Maturity = datetime(2019,12,30); Strike = -0.001075; Reset = 2; Principal = 100; Basis = 0;

The caplets and market data for this example are defined as:

capletDates = cfdates(Settle, Maturity, Reset, Basis); datestr(capletDates')

ans = 6×11 char array

'30-Jun-2017'

'30-Dec-2017'

'30-Jun-2018'

'30-Dec-2018'

'30-Jun-2019'

'30-Dec-2019'

% Market data information MarketStrike = [-0.0013; 0]; MarketMat = [datetime(2017,6,30) ; datetime(2017,12,30) ; datetime(2018,6,30) ; datetime(2018,12,30) ; datetime(2019,6,30) ; datetime(2019,12,30)]; MarketVol = [0.184 0.2329 0.2398 0.2467 0.2906 0.3348; % First row in table corresponding to Strike 1 0.217 0.2707 0.2760 0.2814 0.3160 0.3508]; % Second row in table corresponding to Strike 2

Define the RateSpec using intenvset.

Rates= [-0.002210;-0.002020;-0.00182;-0.001343;-0.001075]; ValuationDate = datetime(2016,12,30); EndDates = [datetime(2017,6,30) ; datetime(2017,12,30) ; datetime(2018,6,30) ; datetime(2018,12,30) ; datetime(2019,12,30)]; Compounding = 2; Basis = 0; RateSpec = intenvset('ValuationDate', ValuationDate, ... 'StartDates', ValuationDate, 'EndDates', EndDates, ... 'Rates', Rates, 'Compounding', Compounding, 'Basis', Basis);

Use hwcalbycap to find values for the volatility parameters Alpha and Sigma using the Normal (Bachelier) model.

format short o=optimoptions('lsqnonlin','TolFun',100*eps); warning ('off','fininst:hwcalbycapfloor:NoConverge') [Alpha, Sigma, OptimOut] = hwcalbycap(RateSpec, MarketStrike, MarketMat,... MarketVol, Strike, Settle, Maturity, 'Reset', Reset, 'Principal', Principal,... 'Basis', Basis, 'OptimOptions', o, 'model', 'normal')

Local minimum possible. lsqnonlin stopped because the size of the current step is less than the value of the step size tolerance. <stopping criteria details>

Alpha = 1.0000e-06

Sigma = 0.3384

OptimOut = struct with fields:

resnorm: 1.5181e-04

residual: [5×1 double]

exitflag: 2

output: [1×1 struct]

lambda: [1×1 struct]

jacobian: [5×2 double]

The OptimOut.residual field of the OptimOut structure is the optimization residual. This value contains the difference between the Normal (Bachelier) caplets and those calculated during the optimization. Use the OptimOut.residual value to calculate the percentual difference (error) compared to Normal (Bachelier) caplet prices, and then decide whether the residual is acceptable. There is almost always some residual, so decide if it is acceptable to parameterize the market with a single value of Alpha and Sigma.

Price the caplets using the market data and Normal (Bachelier) model to obtain the reference caplet values. To determine the effectiveness of the optimization, calculate reference caplet values using the Normal (Bachelier) formula and the market data. Note, you must first interpolate the market data to obtain the caplets for calculation.

[Mats, Strikes] = meshgrid(MarketMat, MarketStrike); MarketMat_T = yearfrac(Settle,Mats); Mats_T = yearfrac(Settle,Maturity); FlatVol = interp2(MarketMat_T, Strikes, MarketVol, Mats_T, Strike, 'spline'); [CapPrice, Caplets] = capbynormal(RateSpec, Strike, Settle, Maturity, FlatVol,... 'Reset', Reset, 'Basis', Basis, 'Principal', Principal); Caplets = Caplets(2:end)'

Caplets = 5×1

4.7392

6.7799

8.2609

9.6136

10.6455

Compare the optimized values and Normal (Bachelier) values, and display the results graphically. After calculating the reference values for the caplets, compare the values analytically and graphically to determine whether the calculated single values of Alpha and Sigma provide an adequate approximation.

OptimCaplets = Caplets+OptimOut.residual;

disp(' ');disp(' Bachelier Calibrated Caplets');Bachelier Calibrated Caplets

disp([Caplets OptimCaplets])

4.7392 4.7453

6.7799 6.7851

8.2609 8.2657

9.6136 9.6112

10.6455 10.6379

plot(MarketMat(2:end), Caplets, 'or', MarketMat(2:end), OptimCaplets, '*b'); xlabel('Caplet Maturity'); ylabel('Caplet Price'); ylim ([0 16]); title('Bachelier and Calibrated Caplets'); h = legend('Bachelier Caplets', 'Calibrated Caplets'); set(h, 'color', [0.9 0.9 0.9]); set(h, 'Location', 'SouthEast'); set(gcf, 'NumberTitle', 'off') grid on

Input Arguments

Market cap strike, specified as a NINST-by-1

vector.

Data Types: double

Market cap maturity dates, specified as a

NINST-by-1 vector using a datetime array, string

array, or date character vectors.

To support existing code, hwcalbycap also

accepts serial date numbers as inputs, but they are not recommended.

Market flat volatilities, specified as a

NSTRIKES-by-NMATS matrix of market flat

volatilities, where NSTRIKES is the number of caplet strikes from

MarketStrike and NMATS is the caplet maturity

dates from MarketMaturity.

Data Types: double

(Optional) Rate at which the cap is exercised, specified as a decimal scalar value.

Data Types: single

(Optional) Settlement date of the cap, specified as a datetime, string, or data character vector.

To support existing code, hwcalbycap also

accepts serial date numbers as inputs, but they are not recommended.

(Optional) Maturity date of the cap, specified as scalar datetime, string, or data character vector.

To support existing code, hwcalbycap also

accepts serial date numbers as inputs, but they are not recommended.

Name-Value Arguments

Specify optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where Name is

the argument name and Value is the corresponding value.

Name-value arguments must appear after other arguments, but the order of the

pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

Example: [Alpha,Sigma,OptimOut] =

hwcalbycap(RateSpec,MarketStrike,MarketMaturity,MarketVolaltility,'Reset',2,'Principal',100000,'Basis',3,'OptimOptions',o)

Frequency of payments per year, specified as the comma-separated pair consisting

of 'Reset' and a scalar numeric value.

Data Types: double

Notional principal amount, specified as the comma-separated pair consisting of

'Principal' and a scalar nonnegative integer.

Data Types: double

Day-count basis used when annualizing the input forward rate, specified as the

comma-separated pair consisting of 'Basis' and a scalar value.

Values are:

0 = actual/actual

1 = 30/360 (SIA)

2 = actual/360

3 = actual/365

4 = 30/360 (PSA)

5 = 30/360 (ISDA)

6 = 30/360 (European)

7 = actual/365 (Japanese)

8 = actual/actual (ICMA)

9 = actual/360 (ICMA)

10 = actual/365 (ICMA)

11 = 30/360E (ICMA)

12 = actual/365 (ISDA)

13 = BUS/252

For more information, see Basis.

Data Types: double

Lower bounds, specified as the comma-separated pair consisting of

'LB' and a 2-by-1 vector of

the lower bounds, defined as [LBSigma; LBAlpha], used in the search

algorithm function. For more information, see lsqnonlin.

Data Types: double

Upper bounds, specified as the comma-separated pair consisting of

'UB' and a 2-by-1 vector of

the upper bounds, defined as [UBSigma; LBAlpha], used in the search

algorithm function. For more information, see lsqnonlin.

Data Types: double

Initial values, specified as the comma-separated pair consisting of

'XO' and a 2-by-1 vector of

the initial values, defined as [Sigma0; Alpha0], used in the search

algorithm function. For more information, see lsqnonlin.

Data Types: double

Optimization parameters, specified as the comma-separated pair consisting of

'OptimOptions' and a structure defined by using optimoptions.

Data Types: struct

Shift in decimals for the shifted Black model, specified as the comma-separated

pair consisting of 'Shift' and a scalar positive decimal value. Set

this parameter to a positive shift in decimals to add a positive shift to forward rate

and Strike, which effectively sets a negative lower bound for

forward rate and Strike. For example, a Shift

value of 0.01 is equal to a 1% shift.

Data Types: double

Indicator for model used for calibration routine, specified as the

comma-separated pair consisting of 'Model' and a scalar character

vector with a value of normal or

lognormal.

Data Types: char

Output Arguments

Mean reversion value obtained from calibrating the cap using market information, returned as a scalar value.

Volatility value obtained from calibrating the cap using market information, returned as a scalar.

Optimization results, returned as a structure.

More About

A cap consists of a series of call options on interest rates, known as "caplets."

Each caplet corresponds to a specific time period (for example, monthly, quarterly) and provides the holder with the right to receive a payment if the reference interest rate (such as LIBOR or SOFR) exceeds the cap rate during that period.

Version History

Introduced in R2009aAlthough hwcalbycap supports serial date numbers,

datetime values are recommended instead. The

datetime data type provides flexible date and time

formats, storage out to nanosecond precision, and properties to account for time

zones and daylight saving time.

To convert serial date numbers or text to datetime values, use the datetime function. For example:

t = datetime(738427.656845093,"ConvertFrom","datenum"); y = year(t)

y =

2021

There are no plans to remove support for serial date number inputs.

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

选择网站

选择网站以获取翻译的可用内容,以及查看当地活动和优惠。根据您的位置,我们建议您选择:。

您也可以从以下列表中选择网站:

如何获得最佳网站性能

选择中国网站(中文或英文)以获得最佳网站性能。其他 MathWorks 国家/地区网站并未针对您所在位置的访问进行优化。

美洲

- América Latina (Español)

- Canada (English)

- United States (English)

欧洲

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)