Market Risk

Risk of loss arising from movements in market prices

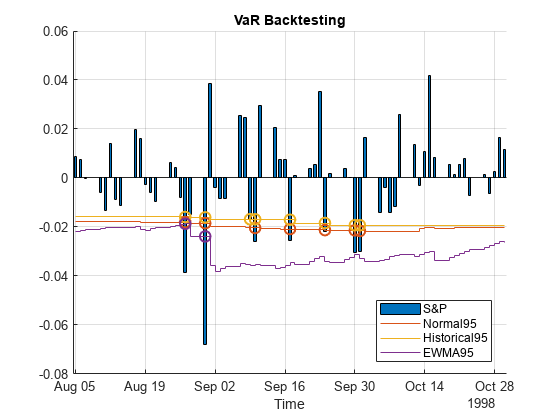

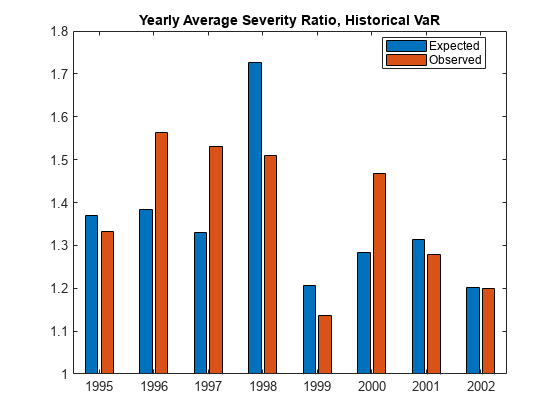

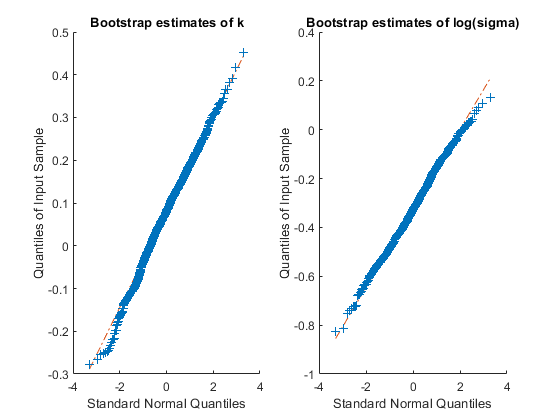

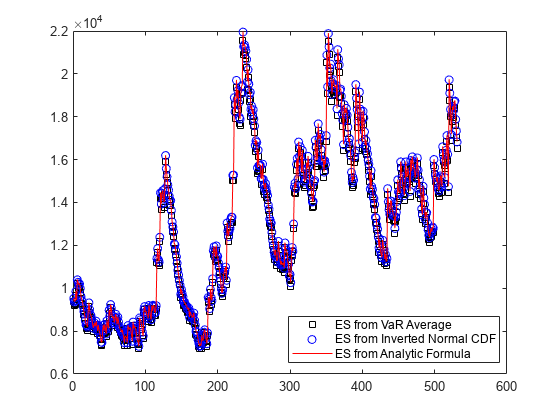

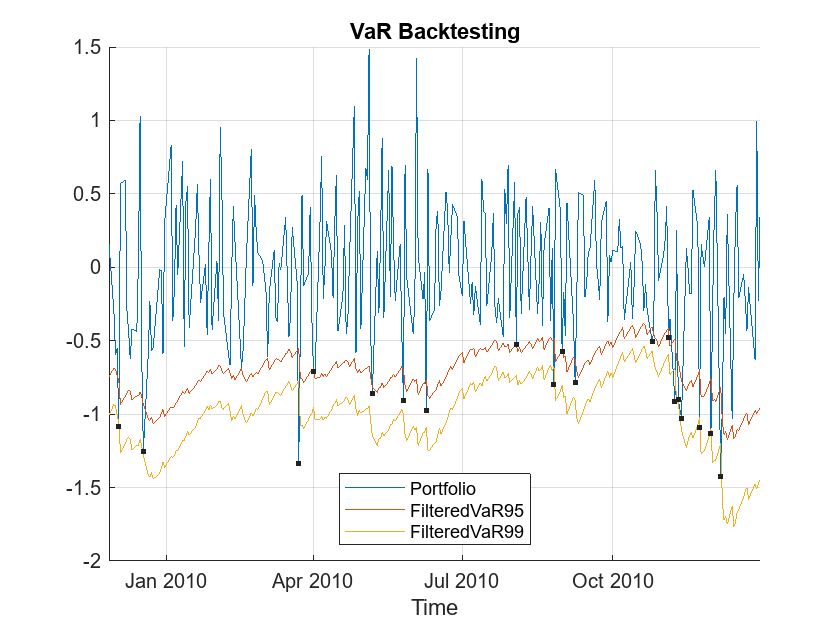

Value-at-risk (VaR) and expected shortfall (ES) are important measures of financial risk. VaR is an estimate of how much value a portfolio can lose in a given time period with a given confidence level. ES is the expected loss on days when there is a VaR failure. VaR and ES backtesting tools assess the accuracy of VaR and ES models.

Categories

- Estimate VaR and ES Values

Calculate value-at-risk (VaR) and expected shortfall (ES) for portfolio returns distributions

- VaR Backtest

Create a VaR (value-at-risk) backtest model and run suite of VaR backtests

- Expected Shortfall Backtest

Create an expected shortfall (ES) backtest model and run suite of ES backtests