Expected Credit Loss Computation

This example shows how to perform expected credit loss (ECL) computations with portfolioECL using simulated loan data, macro scenario data, and an existing lifetime probability of default (PD) model.

Load Data and Model

Load loan data ready for prediction, macro scenario data, and corresponding scenario probabilities.

load DataPredictLifetime.mat

disp(LoanData) ID ScoreGroup YOB Year

____ _____________ ___ ____

1304 "Medium Risk" 4 2020

1304 "Medium Risk" 5 2021

1304 "Medium Risk" 6 2022

1304 "Medium Risk" 7 2023

1304 "Medium Risk" 8 2024

1304 "Medium Risk" 9 2025

1304 "Medium Risk" 10 2026

2067 "Low Risk" 7 2020

2067 "Low Risk" 8 2021

2067 "Low Risk" 9 2022

2067 "Low Risk" 10 2023

disp(head(MultipleScenarios,10))

ScenarioID Year GDP Market

__________ ____ ____ ______

"Severe" 2020 -0.9 -5.5

"Severe" 2021 -0.5 -6.5

"Severe" 2022 0.2 -1

"Severe" 2023 0.8 1.5

"Severe" 2024 1.4 4

"Severe" 2025 1.8 6.5

"Severe" 2026 1.8 6.5

"Severe" 2027 1.8 6.5

"Adverse" 2020 0.1 -0.5

"Adverse" 2021 0.2 -2.5

disp(ScenarioProbabilities)

Probability

___________

Severe 0.1

Adverse 0.2

Baseline 0.3

Favorable 0.2

Excellent 0.2

load LifetimeChampionModel.mat

disp(pdModel) Probit with properties:

ModelID: "Champion"

Description: "A sample model used as champion model for illustration purposes."

UnderlyingModel: [1×1 classreg.regr.CompactGeneralizedLinearModel]

IDVar: "ID"

AgeVar: "YOB"

LoanVars: "ScoreGroup"

MacroVars: ["GDP" "Market"]

ResponseVar: "Default"

WeightsVar: ""

TimeInterval: []

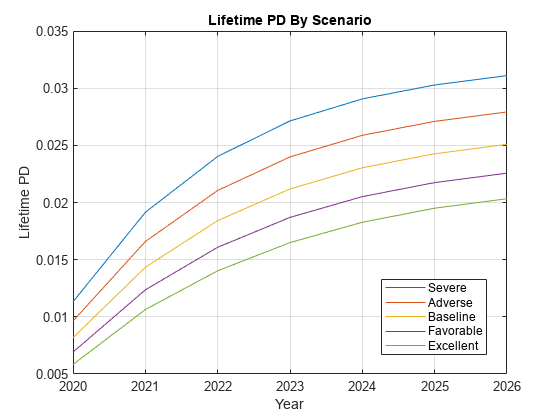

Visualize Lifetime PDs

For ECL computations, only the marginal PDs are required. However, first you can visualize the lifetime PDs.

CompanyIDChoice ="1304"; CompanyID = str2double(CompanyIDChoice); IndCompany = LoanData.ID == CompanyID; Years = LoanData.Year(IndCompany); NumYears = length(Years); ScenarioID = unique(MultipleScenarios.ScenarioID,'stable'); NumScenarios = length(ScenarioID); LifetimePD = zeros(NumYears,NumScenarios); for ii=1:NumScenarios IndScenario = MultipleScenarios.ScenarioID==ScenarioID(ii); data = join(LoanData(IndCompany,:),MultipleScenarios(IndScenario,:)); LifetimePD(:,ii) = predictLifetime(pdModel,data); end plot(Years,LifetimePD) xticks(Years) grid on xlabel('Year') ylabel('Lifetime PD') title('Lifetime PD By Scenario') legend(ScenarioID,'Location','best')

Compute ECL

The computation of ECL requires a marginal PD values, LGD values, and EAD values, effective interest rate, plus the scenarios and scenario probabilities.

Compute the lifetime ECL using the portfolioECL function. The inputs to this function are tables, where the first column is an ID variable that indicates which rows correspond to which loan. Because the projections cover multiple periods for each loan, and the remaining life of different loans may be different, the ID variable is an important input. For each ID, the credit projections must be provided, period-by-period, until the end of the life of each loan. Typically, the marginal PD has a multi-period and multi-scenario size. This example assumes constant LGD and EAD values. This means that the same LGD and EAD is used for all periods, and the LGD and EAD values are not sensitive to the scenarios. Hence, the marginal PD input has multiple rows and columns per ID, whereas the LGD and EAD inputs have one scalar value per ID. To offer flexibility for different input dimensions for marginal PD, LGD, and EAD inputs, these inputs are separated into three separate tables in the syntax of portfolioECL.

ScenarioID = unique(MultipleScenarios.ScenarioID,'stable');

NumScenarios = length(ScenarioID);Predict marginal PD for each scenario. The predictLifetime function is called for the entire portfolio at once, and the marginal PDs for each scenario are stored as columns.

MarginalPD = zeros(height(LoanData),NumScenarios); for ii=1:NumScenarios IndScenario = MultipleScenarios.ScenarioID==ScenarioID(ii); data = join(LoanData,MultipleScenarios(IndScenario,:)); MarginalPD(:,ii) = predictLifetime(pdModel,data,'ProbabilityType','marginal'); end

Convert to the required table input format, with the ID column.

MarginalPDTable = array2table(MarginalPD); MarginalPDTable.Properties.VariableNames = ScenarioID; MarginalPDTable = addvars(MarginalPDTable,LoanData.ID,'Before',1,'NewVariableNames','ID'); disp(MarginalPDTable)

ID Severe Adverse Baseline Favorable Excellent

____ __________ __________ __________ __________ __________

1304 0.011316 0.0096361 0.0081783 0.006918 0.0058324

1304 0.0078277 0.0069482 0.0061554 0.0054425 0.0048028

1304 0.0048869 0.0044693 0.0040823 0.0037243 0.0033938

1304 0.0031017 0.0029321 0.0027698 0.0026147 0.0024668

1304 0.0019309 0.0018923 0.0018538 0.0018153 0.001777

1304 0.0012157 0.0012197 0.0012233 0.0012264 0.0012293

1304 0.00082053 0.00082322 0.00082562 0.00082775 0.00082964

2067 0.0022199 0.001832 0.0015067 0.001235 0.0010088

2067 0.0014464 0.0012534 0.0010841 0.00093599 0.00080662

2067 0.0008343 0.00074897 0.00067168 0.00060175 0.00053857

2067 0.00049107 0.00045839 0.00042769 0.00039887 0.00037183

The LGD and EAD table inputs are small tables with one row per ID.

UniqueIDs = unique(LoanData.ID,'stable'); NumIDs = length(UniqueIDs); LGD = 0.55; LGDTable = table(UniqueIDs, repmat(LGD,NumIDs,1),'VariableNames',{'ID','LGD'}); disp(LGDTable)

ID LGD

____ ____

1304 0.55

2067 0.55

EAD = 100000; EADTable = table(UniqueIDs, repmat(EAD,NumIDs,1),'VariableNames',{'ID','EAD'}); disp(EADTable)

ID EAD

____ _____

1304 1e+05

2067 1e+05

For simplicity, assume the same effective interest rate for both loans.

EffRate = 0.045;

Call the portfolioECL function. The first output is the total ECL, or provisions, for the portfolio.

[totalECL, ECLByID, ECLByPeriod] = portfolioECL(MarginalPDTable, LGDTable, EADTable, 'InterestRate', EffRate,... 'ScenarioNames',ScenarioID, 'ScenarioProbabilities',ScenarioProbabilities.Probability, 'IDVar','ID','Periodicity','annual'); fprintf('Total portfolio lifetime ECL is: %.2f\n',totalECL)

Total portfolio lifetime ECL is: 1401.00

The second output, ECLByID, shows the ECL for each ID. The third output, ECLByPeriod, shows the ECL for each period, and each scenario. Use the dropdown to select an ID and display the corresponding ECL information.

CompanyIDChoice =  "1304";

CompanyID = str2double(CompanyIDChoice);

disp(ECLByID(ECLByID.ID==CompanyID,:))

"1304";

CompanyID = str2double(CompanyIDChoice);

disp(ECLByID(ECLByID.ID==CompanyID,:)) ID ECL

____ ______

1304 1217.3

disp(ECLByPeriod(ECLByPeriod.ID==CompanyID,:))

ID TimePeriod Severe Adverse Baseline Favorable Excellent

____ __________ ______ _______ ________ _________ _________

1304 1 595.58 507.16 430.44 364.11 306.97

1304 2 394.24 349.95 310.02 274.11 241.9

1304 3 235.53 215.4 196.75 179.5 163.57

1304 4 143.05 135.23 127.75 120.59 113.77

1304 5 85.219 83.517 81.816 80.118 78.429

1304 6 51.346 51.514 51.665 51.798 51.917

1304 7 33.162 33.271 33.368 33.454 33.531

For more information, see the Incorporate Macroeconomic Scenario Projections in Loan Portfolio ECL Calculations example that shows a detailed workflow for ECL calculations, including the determination of macro scenarios, the use of lifetime PD, LGD and EAD models, and a visualization of credit projections and provisions for each ID to drill down to a loan level.

See Also

fitLifetimePDModel | predict | predictLifetime | modelDiscrimination | modelCalibration | modelCalibrationPlot | Logistic | Probit | Cox

Topics

- Basic Lifetime PD Model Validation

- Compare Lifetime PD Models Using Cross-Validation

- Compare Logistic Model for Lifetime PD to Champion Model

- Compare Model Discrimination and Model Calibration to Validate of Probability of Default

- Compare Probability of Default Using Through-the-Cycle and Point-in-Time Models