equityCurve

Description

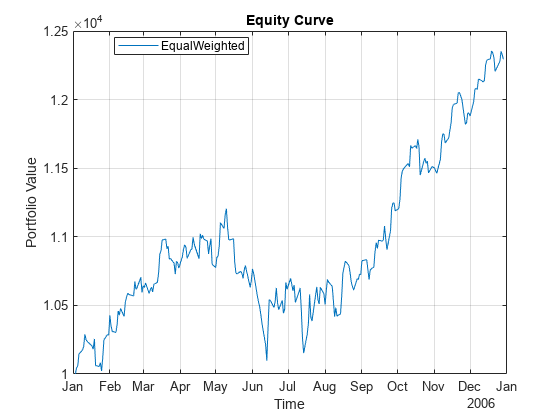

equityCurve( plots the equity

curves of each strategy that you create using backtester)backtestStrategy. After creating

the backtesting engine using backtestEngine and running the

backtest with runBacktest, use

equityCurve to plot the strategies and compare their

performance.

h = equityCurve(ax,backtester)h for the equity curve

plot.

Examples

Input Arguments

Output Arguments

Version History

Introduced in R2021a