simulateNormalScenariosByData

Simulate multivariate normal asset return scenarios from data

Syntax

Description

obj = simulateNormalScenariosByData(obj,AssetReturns)PortfolioCVaR or PortfolioMAD

objects. For details on the workflows, see PortfolioCVaR Object Workflow,

and PortfolioMAD Object Workflow.

obj = simulateNormalScenariosByData(obj,AssetReturns,NumScenarios,Name,Value)PortfolioCVaR or PortfolioMAD

objects using additional options specified by one or more

Name,Value pair arguments.

This function estimates the mean and covariance of asset returns from either

price or return data and then uses these estimates to generate the specified

number of scenarios with the function mvnrnd.

Data can be in a NumSamples-by-NumAssets

matrix of NumSamples prices or returns at a given periodicity

for a collection of NumAssets assets, a table or a timetable.

Note

If you want to use the method multiple times and you want to simulate

identical scenarios each time the function is called, precede each

function call with rng(seed) using a specified integer

seed.

Examples

Given a PortfolioCVaR object p, use the simulateNormalScenariosByData function to simulate multivariate normal asset return scenarios from data.

m = [ 0.05; 0.1; 0.12; 0.18 ];

C = [ 0.0064 0.00408 0.00192 0;

0.00408 0.0289 0.0204 0.0119;

0.00192 0.0204 0.0576 0.0336;

0 0.0119 0.0336 0.1225 ];

m = m/12;

C = C/12;

RawData = mvnrnd(m, C, 240);

NumScenarios = 2000;

p = PortfolioCVaR;

p = simulateNormalScenariosByData(p, RawData, NumScenarios)p =

PortfolioCVaR with properties:

BuyCost: []

SellCost: []

RiskFreeRate: []

ProbabilityLevel: []

Turnover: []

BuyTurnover: []

SellTurnover: []

NumScenarios: 2000

Name: []

NumAssets: 4

AssetList: []

InitPort: []

AInequality: []

bInequality: []

AEquality: []

bEquality: []

LowerBound: []

UpperBound: []

LowerBudget: []

UpperBudget: []

GroupMatrix: []

LowerGroup: []

UpperGroup: []

GroupA: []

GroupB: []

LowerRatio: []

UpperRatio: []

MinNumAssets: []

MaxNumAssets: []

ConditionalBudgetThreshold: []

ConditionalUpperBudget: []

BoundType: []

p = setDefaultConstraints(p); p = setProbabilityLevel(p, 0.9); disp(p);

PortfolioCVaR with properties:

BuyCost: []

SellCost: []

RiskFreeRate: []

ProbabilityLevel: 0.9000

Turnover: []

BuyTurnover: []

SellTurnover: []

NumScenarios: 2000

Name: []

NumAssets: 4

AssetList: []

InitPort: []

AInequality: []

bInequality: []

AEquality: []

bEquality: []

LowerBound: [4×1 double]

UpperBound: []

LowerBudget: 1

UpperBudget: 1

GroupMatrix: []

LowerGroup: []

UpperGroup: []

GroupA: []

GroupB: []

LowerRatio: []

UpperRatio: []

MinNumAssets: []

MaxNumAssets: []

ConditionalBudgetThreshold: []

ConditionalUpperBudget: []

BoundType: [4×1 categorical]

To illustrate using the simulateNormalScenariosByData function with AssetReturns data continued in a timetable object, use the CAPMuniverse.mat which contains a timetable object (AssetTimeTable) for returns data.

load CAPMuniverse;

AssetsTimeTable.Propertiesans =

TimetableProperties with properties:

Description: ''

UserData: []

DimensionNames: {'Time' 'Variables'}

VariableNames: {'AAPL' 'AMZN' 'CSCO' 'DELL' 'EBAY' 'GOOG' 'HPQ' 'IBM' 'INTC' 'MSFT' 'ORCL' 'YHOO' 'MARKET' 'CASH'}

VariableTypes: ["double" "double" "double" "double" "double" "double" "double" "double" "double" "double" "double" "double" "double" "double"]

VariableDescriptions: {}

VariableUnits: {}

VariableContinuity: []

RowTimes: [1471×1 datetime]

StartTime: 03-Jan-2000

SampleRate: NaN

TimeStep: NaN

Events: []

CustomProperties: No custom properties are set.

Use addprop and rmprop to modify CustomProperties.

head(AssetsTimeTable,5)

Time AAPL AMZN CSCO DELL EBAY GOOG HPQ IBM INTC MSFT ORCL YHOO MARKET CASH

___________ _________ _________ _________ _________ _________ ____ _________ _________ _________ _________ _________ _________ _________ __________

03-Jan-2000 0.088805 0.1742 0.008775 -0.002353 0.12829 NaN 0.03244 0.075368 0.05698 -0.001627 0.054078 0.097784 -0.012143 0.00020522

04-Jan-2000 -0.084331 -0.08324 -0.05608 -0.08353 -0.093805 NaN -0.075613 -0.033966 -0.046667 -0.033802 -0.0883 -0.067368 -0.03166 0.00020339

05-Jan-2000 0.014634 -0.14877 -0.003039 0.070984 0.066875 NaN -0.006356 0.03516 0.008199 0.010567 -0.052837 -0.073363 0.011443 0.00020376

06-Jan-2000 -0.086538 -0.060072 -0.016619 -0.038847 -0.012302 NaN -0.063688 -0.017241 -0.05824 -0.033477 -0.058824 -0.10307 0.011743 0.00020266

07-Jan-2000 0.047368 0.061013 0.0587 -0.037708 -0.000964 NaN 0.028416 -0.004386 0.04127 0.013091 0.076771 0.10609 0.02393 0.00020157

Notice that GOOG has missing data (NaN) because it was not listed before Aug 2004. The simulateNormalScenariosByData function has a name-value pair argument 'MissingData' that indicates with a Boolean value whether to use the missing data capabilities of Financial Toolbox™ software. The default value for 'MissingData' is false which removes all samples with NaN values. If, however, 'MissingData' is set to true, the estimateAssetMoments function uses the ECM algorithm to estimate asset moments. The simulateNormalScenariosByData function also accepts a name-value pair argument 'DataFormat' with a corresponding value set to 'prices' to indicate that the input to the function is in the form of asset prices and not returns (the default value for the 'DataFormat' argument is 'returns').

NumScenarios = 100; r = PortfolioCVaR; r = simulateNormalScenariosByData(r,AssetsTimeTable,NumScenarios,'DataFormat','Returns','MissingData',true);

In addition, simulateNormalScenariosByData extracts asset names or identifiers from a timetable object when the name-value argument 'GetAssetList' is set to true (its default value is false). If the 'GetAssetList' value is true, the timetable column identifiers are used to set the AssetList property of the PortfolioCVaR object. To show this, the formation of the PortfolioCVaR object r is repeated with the 'GetAssetList' flag set to true.

r = simulateNormalScenariosByData(r,AssetsTimeTable,NumScenarios,'GetAssetList',true);

disp(r.AssetList) {'AAPL'} {'AMZN'} {'CSCO'} {'DELL'} {'EBAY'} {'GOOG'} {'HPQ'} {'IBM'} {'INTC'} {'MSFT'} {'ORCL'} {'YHOO'} {'MARKET'} {'CASH'}

Create a PortfolioCVaR object p and use the simulateNormalScenariosByData function with market data loaded from CAPMuniverse.mat to simulate multivariate normal asset return scenarios. The market data, AssetsTimeTable, is a timetable of asset returns.

load CAPMuniverse p = PortfolioCVaR('AssetList',Assets); disp(p);

PortfolioCVaR with properties:

BuyCost: []

SellCost: []

RiskFreeRate: []

ProbabilityLevel: []

Turnover: []

BuyTurnover: []

SellTurnover: []

NumScenarios: []

Name: []

NumAssets: 14

AssetList: {'AAPL' 'AMZN' 'CSCO' 'DELL' 'EBAY' 'GOOG' 'HPQ' 'IBM' 'INTC' 'MSFT' 'ORCL' 'YHOO' 'MARKET' 'CASH'}

InitPort: []

AInequality: []

bInequality: []

AEquality: []

bEquality: []

LowerBound: []

UpperBound: []

LowerBudget: []

UpperBudget: []

GroupMatrix: []

LowerGroup: []

UpperGroup: []

GroupA: []

GroupB: []

LowerRatio: []

UpperRatio: []

MinNumAssets: []

MaxNumAssets: []

ConditionalBudgetThreshold: []

ConditionalUpperBudget: []

BoundType: []

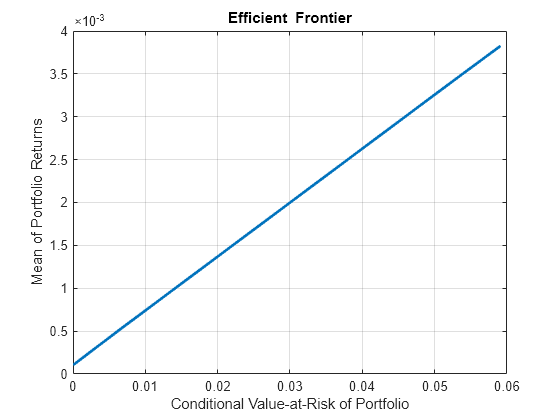

Simulate the scenarios from the timetable data for each of the assets from CAPMuniverse.mat and plot the efficient frontier.

p = simulateNormalScenariosByData(p,AssetsTimeTable,10000,'missingdata',true);

p = setDefaultConstraints(p);

p = setProbabilityLevel(p, 0.9);

plotFrontier(p);

Given a PortfolioMAD object p, use the simulateNormalScenariosByData function to simulate multivariate normal asset return scenarios from data.

m = [ 0.05; 0.1; 0.12; 0.18 ];

C = [ 0.0064 0.00408 0.00192 0;

0.00408 0.0289 0.0204 0.0119;

0.00192 0.0204 0.0576 0.0336;

0 0.0119 0.0336 0.1225 ];

m = m/12;

C = C/12;

RawData = mvnrnd(m, C, 240);

NumScenarios = 2000;

p = PortfolioMAD;

p = simulateNormalScenariosByData(p, RawData, NumScenarios);

p = setDefaultConstraints(p);

disp(p); PortfolioMAD with properties:

BuyCost: []

SellCost: []

RiskFreeRate: []

Turnover: []

BuyTurnover: []

SellTurnover: []

NumScenarios: 2000

Name: []

NumAssets: 4

AssetList: []

InitPort: []

AInequality: []

bInequality: []

AEquality: []

bEquality: []

LowerBound: [4×1 double]

UpperBound: []

LowerBudget: 1

UpperBudget: 1

GroupMatrix: []

LowerGroup: []

UpperGroup: []

GroupA: []

GroupB: []

LowerRatio: []

UpperRatio: []

MinNumAssets: []

MaxNumAssets: []

ConditionalBudgetThreshold: []

ConditionalUpperBudget: []

BoundType: [4×1 categorical]

Create a PortfolioMAD object p and use the simulateNormalScenariosByData function with market data loaded from CAPMuniverse.mat to simulate multivariate normal asset return scenarios. The market data, AssetsTimeTable, is a timetable of asset returns.

load CAPMuniverse p = PortfolioMAD('AssetList',Assets); disp(p.AssetList');

{'AAPL' }

{'AMZN' }

{'CSCO' }

{'DELL' }

{'EBAY' }

{'GOOG' }

{'HPQ' }

{'IBM' }

{'INTC' }

{'MSFT' }

{'ORCL' }

{'YHOO' }

{'MARKET'}

{'CASH' }

Simulate the scenarios from the timetable data for each of the assets from CAPMuniverse.mat and plot the efficient frontier.

p = simulateNormalScenariosByData(p,AssetsTimeTable,10000,'missingdata',true);

p = setDefaultConstraints(p);

plotFrontier(p);

Input Arguments

Object for portfolio, specified using a PortfolioCVaR

or PortfolioMAD object.

For more information on creating a PortfolioCVaR or

PortfolioMAD object, see

Data Types: object

Asset data that can be converted into asset returns

([NumSamples-by-NumAssets]

matrix), specified as a matrix, table, or timetable.

AssetReturns data can be:

NumSamples-by-NumAssetsmatrix.Table of

NumSamplesprices or returns at a given periodicity for a collection ofNumAssetsassetsTimetable object with

NumSamplesobservations andNumAssetstime series

Data Types: double | table | timetable

Number of scenarios to simulate, specified as a positive integer.

Data Types: double

Name-Value Arguments

Specify optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where Name is

the argument name and Value is the corresponding value.

Name-value arguments must appear after other arguments, but the order of the

pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

Example: p =

simulateNormalScenariosByData(p,RawData,NumScenarios,'DataFormat','Returns','MissingData',true,'GetAssetList',true)

Flag to convert input data as prices into returns, specified as the

comma-separated pair consisting of 'DataFormat' and a

character vector with the values:

'Returns'— Data inAssetReturnscontains asset total returns.'Prices'— Data inAssetReturnscontains asset total return prices.

Data Types: char

Flag to use ECM algorithm to handle NaN values,

specified as the comma-separated pair consisting of

'MissingData' and a logical with a value of

true or false.

false— Do not use ECM algorithm to handleNaNvalues (excludeNaNvalues).true— Use ECM algorithm to handleNaNvalues.

Data Types: logical

Flag indicating which asset names to use for the asset list, specified

as the comma-separated pair consisting of

'GetAssetList' and a logical with a value of

true or false.

false— Do not extract or create asset names.true— Extract or create asset names from the table or timetable.

If a table or timetable is passed into

this function using the AssetReturns argument and

the GetAssetList flag is true, the

column names from the table or timetable are used as

asset names in obj.AssetList.

If a matrix is passed and the GetAssetList flag is

true, default asset names are created based on

the AbstractPortfolio property

defaultforAssetList, which is

'Asset'.

If the GetAssetList flag is

false, no action occurs, which is the default

behavior.

Data Types: logical

Output Arguments

Updated portfolio object, returned as a PortfolioCVaR

or PortfolioMAD object. For more information on creating

a portfolio object, see

Tips

You can also use dot notation to simulate multivariate normal asset return scenarios from data for a PortfolioCVaR or PortfolioMAD object.

obj = obj.simulateNormalScenariosByData(AssetReturns,NumScenarios,Name,Value);

Version History

Introduced in R2012bThe AssetReturns argument no longer supports a

fints object as a datatype.

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

选择网站

选择网站以获取翻译的可用内容,以及查看当地活动和优惠。根据您的位置,我们建议您选择:。

您也可以从以下列表中选择网站:

如何获得最佳网站性能

选择中国网站(中文或英文)以获得最佳网站性能。其他 MathWorks 国家/地区网站并未针对您所在位置的访问进行优化。

美洲

- América Latina (Español)

- Canada (English)

- United States (English)

欧洲

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)