Case Study for Credit Scorecard Analysis

This example shows how to create a creditscorecard object, bin data, display, and plot binned data information. This example also shows how to fit a logistic regression model, obtain a score for the scorecard model, and determine the probabilities of default and validate the credit scorecard model using three different metrics.

Step 1. Create a creditscorecard object.

Use the CreditCardData.mat file to load the data (using a dataset from Refaat 2011). If your data contains many predictors, you can first use screenpredictors (Risk Management Toolbox) to pare down a potentially large set of predictors to a subset that is most predictive of the credit scorecard response variable. You can then use this subset of predictors when creating the creditscorecard object. In addition, you can use Threshold Predictors (Risk Management Toolbox) to interactively set credit scorecard predictor thresholds using the output from screenpredictors (Risk Management Toolbox).

When creating a creditscorecard object, by default, 'ResponseVar' is set to the last column in the data ('status' in this example) and the 'GoodLabel' to the response value with the highest count (0 in this example). The syntax for creditscorecard indicates that 'CustID' is the 'IDVar' to remove from the list of predictors. Also, while not demonstrated in this example, when creating a creditscorecard object using creditscorecard, you can use the optional name-value pair argument 'WeightsVar' to specify observation (sample) weights or 'BinMissingData' to bin missing data.

load CreditCardData

head(data) CustID CustAge TmAtAddress ResStatus EmpStatus CustIncome TmWBank OtherCC AMBalance UtilRate status

______ _______ ___________ __________ _________ __________ _______ _______ _________ ________ ______

1 53 62 Tenant Unknown 50000 55 Yes 1055.9 0.22 0

2 61 22 Home Owner Employed 52000 25 Yes 1161.6 0.24 0

3 47 30 Tenant Employed 37000 61 No 877.23 0.29 0

4 50 75 Home Owner Employed 53000 20 Yes 157.37 0.08 0

5 68 56 Home Owner Employed 53000 14 Yes 561.84 0.11 0

6 65 13 Home Owner Employed 48000 59 Yes 968.18 0.15 0

7 34 32 Home Owner Unknown 32000 26 Yes 717.82 0.02 1

8 50 57 Other Employed 51000 33 No 3041.2 0.13 0

The variables in CreditCardData are customer ID, customer age, time at current address, residential status, employment status, customer income, time with bank, other credit card, average monthly balance, utilization rate, and the default status (response).

sc = creditscorecard(data,'IDVar','CustID')

sc =

creditscorecard with properties:

GoodLabel: 0

ResponseVar: 'status'

WeightsVar: ''

VarNames: {'CustID' 'CustAge' 'TmAtAddress' 'ResStatus' 'EmpStatus' 'CustIncome' 'TmWBank' 'OtherCC' 'AMBalance' 'UtilRate' 'status'}

NumericPredictors: {'CustAge' 'TmAtAddress' 'CustIncome' 'TmWBank' 'AMBalance' 'UtilRate'}

CategoricalPredictors: {'ResStatus' 'EmpStatus' 'OtherCC'}

BinMissingData: 0

IDVar: 'CustID'

PredictorVars: {'CustAge' 'TmAtAddress' 'ResStatus' 'EmpStatus' 'CustIncome' 'TmWBank' 'OtherCC' 'AMBalance' 'UtilRate'}

Data: [1200×11 table]

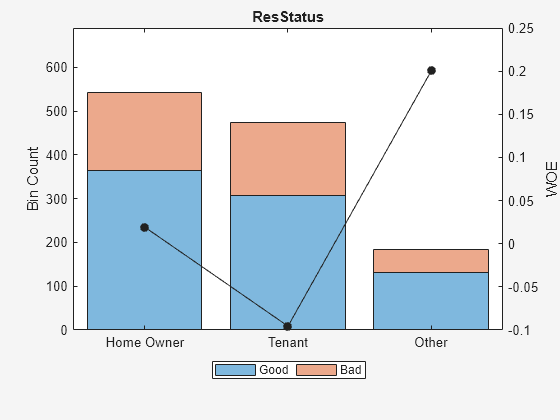

Perform some initial data exploration. Inquire about predictor statistics for the categorical variable 'ResStatus' and plot the bin information for 'ResStatus'.

bininfo(sc,'ResStatus')ans=4×6 table

Bin Good Bad Odds WOE InfoValue

______________ ____ ___ ______ _________ _________

{'Home Owner'} 365 177 2.0621 0.019329 0.0001682

{'Tenant' } 307 167 1.8383 -0.095564 0.0036638

{'Other' } 131 53 2.4717 0.20049 0.0059418

{'Totals' } 803 397 2.0227 NaN 0.0097738

plotbins(sc,'ResStatus')

This bin information contains the frequencies of “Good” and “Bad,” and bin statistics. Avoid having bins with frequencies of zero because they lead to infinite or undefined (NaN) statistics. Use the modifybins or autobinning functions to bin the data accordingly.

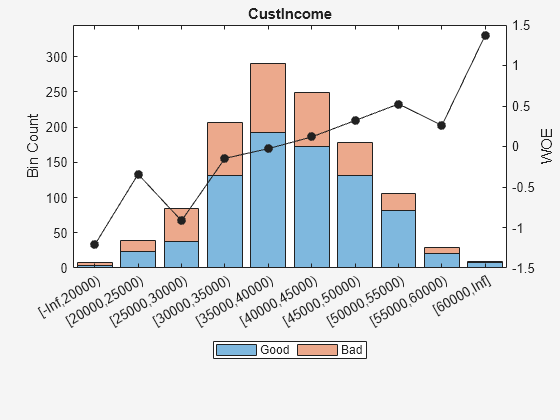

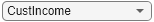

For numeric data, a common first step is "fine classing." This means binning the data into several bins, defined with a regular grid. To illustrate this point, use the predictor 'CustIncome'.

cp = 20000:5000:60000; sc = modifybins(sc,'CustIncome','CutPoints',cp); bininfo(sc,'CustIncome')

ans=11×6 table

Bin Good Bad Odds WOE InfoValue

_________________ ____ ___ _______ _________ __________

{'[-Inf,20000)' } 3 5 0.6 -1.2152 0.010765

{'[20000,25000)'} 23 16 1.4375 -0.34151 0.0039819

{'[25000,30000)'} 38 47 0.80851 -0.91698 0.065166

{'[30000,35000)'} 131 75 1.7467 -0.14671 0.003782

{'[35000,40000)'} 193 98 1.9694 -0.026696 0.00017359

{'[40000,45000)'} 173 76 2.2763 0.11814 0.0028361

{'[45000,50000)'} 131 47 2.7872 0.32063 0.014348

{'[50000,55000)'} 82 24 3.4167 0.52425 0.021842

{'[55000,60000)'} 21 8 2.625 0.26066 0.0015642

{'[60000,Inf]' } 8 1 8 1.375 0.010235

{'Totals' } 803 397 2.0227 NaN 0.13469

plotbins(sc,'CustIncome')

Step 2a. Automatically bin the data.

Use the autobinning function to perform automatic binning for every predictor variable, using the default 'Monotone' algorithm with default algorithm options.

sc = autobinning(sc);

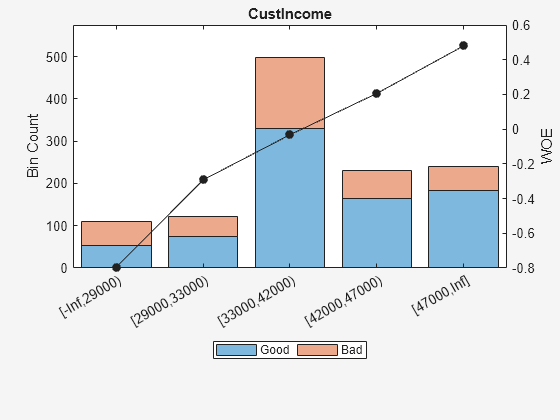

After the automatic binning step, every predictor bin must be reviewed using the bininfo and plotbins functions and fine-tuned. A monotonic, ideally linear trend in the Weight of Evidence (WOE) is desirable for credit scorecards because this translates into linear points for a given predictor. The WOE trends can be visualized using plotbins.

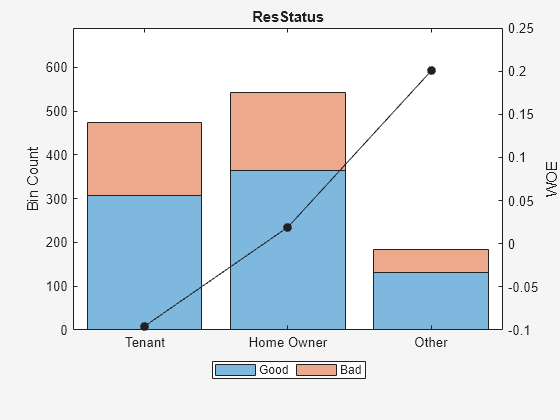

Predictor =  'ResStatus';

plotbins(sc,Predictor)

'ResStatus';

plotbins(sc,Predictor)

Unlike the initial plot of 'ResStatus' when the scorecard was created, the new plot for 'ResStatus' shows an increasing WOE trend. This is because the autobinning function, by default, sorts the order of the categories by increasing odds.

These plots show that the 'Monotone' algorithm does a good job finding monotone WOE trends for this dataset. To complete the binning process, it is necessary to make only a few manual adjustments for some predictors using the modifybins function.

Step 2b. Fine-tune the bins using manual binning.

Common steps to manually modify bins are:

Use the

bininfofunction with two output arguments where the second argument contains binning rules.Manually modify the binning rules using the second output argument from

bininfo.Set the updated binning rules with

modifybinsand then useplotbinsorbininfoto review the updated bins.

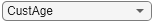

For example, based on the plot for 'CustAge' in Step 2a, bins number 1 and 2 have similar WOE's as do bins number 5 and 6. To merge these bins using the steps outlined above:

Predictor =  'CustAge';

[bi,cp] = bininfo(sc,Predictor)

'CustAge';

[bi,cp] = bininfo(sc,Predictor)bi=8×6 table

Bin Good Bad Odds WOE InfoValue

_____________ ____ ___ ______ _________ _________

{'[-Inf,33)'} 70 53 1.3208 -0.42622 0.019746

{'[33,37)' } 64 47 1.3617 -0.39568 0.015308

{'[37,40)' } 73 47 1.5532 -0.26411 0.0072573

{'[40,46)' } 174 94 1.8511 -0.088658 0.001781

{'[46,48)' } 61 25 2.44 0.18758 0.0024372

{'[48,58)' } 263 105 2.5048 0.21378 0.013476

{'[58,Inf]' } 98 26 3.7692 0.62245 0.0352

{'Totals' } 803 397 2.0227 NaN 0.095205

cp = 6×1

33

37

40

46

48

58

cp([1 5]) = []; % To merge bins 1 and 2, and bins 5 and 6 sc = modifybins(sc,'CustAge','CutPoints',cp); plotbins(sc,'CustAge')

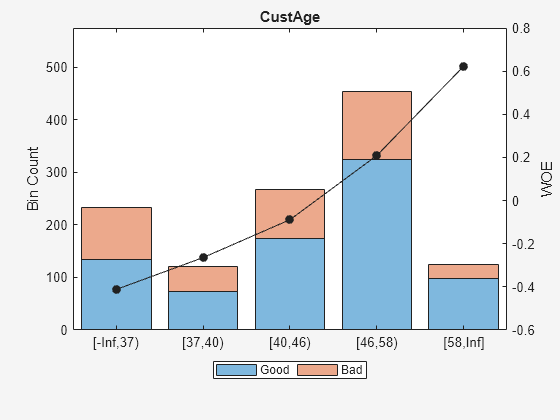

For 'CustIncome', based on the plot above, it is best to merge bins 3, 4 and 5 because they have similar WOE's. To merge these bins:

Predictor =  'CustIncome';

[bi,cp] = bininfo(sc,Predictor)

'CustIncome';

[bi,cp] = bininfo(sc,Predictor)bi=8×6 table

Bin Good Bad Odds WOE InfoValue

_________________ ____ ___ _______ _________ __________

{'[-Inf,29000)' } 53 58 0.91379 -0.79457 0.06364

{'[29000,33000)'} 74 49 1.5102 -0.29217 0.0091366

{'[33000,35000)'} 68 36 1.8889 -0.06843 0.00041042

{'[35000,40000)'} 193 98 1.9694 -0.026696 0.00017359

{'[40000,42000)'} 68 34 2 -0.011271 1.0819e-05

{'[42000,47000)'} 164 66 2.4848 0.20579 0.0078175

{'[47000,Inf]' } 183 56 3.2679 0.47972 0.041657

{'Totals' } 803 397 2.0227 NaN 0.12285

cp = 6×1

29000

33000

35000

40000

42000

47000

cp([3 4]) = []; % To merge bins 3, 4, and 5 sc = modifybins(sc,'CustIncome','CutPoints',cp); plotbins(sc,'CustIncome')

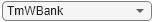

For 'TmWBank', based on the plot above, it is best to merge bins 2 and 3 because they have similar WOE's. To merge these bins:

Predictor =  'TmWBank';

[bi,cp] = bininfo(sc,Predictor)

'TmWBank';

[bi,cp] = bininfo(sc,Predictor)bi=6×6 table

Bin Good Bad Odds WOE InfoValue

_____________ ____ ___ ______ ________ _________

{'[-Inf,12)'} 141 90 1.5667 -0.25547 0.013057

{'[12,23)' } 165 93 1.7742 -0.13107 0.0037719

{'[23,45)' } 224 125 1.792 -0.12109 0.0043479

{'[45,71)' } 177 67 2.6418 0.26704 0.013795

{'[71,Inf]' } 96 22 4.3636 0.76889 0.049313

{'Totals' } 803 397 2.0227 NaN 0.084284

cp = 4×1

12

23

45

71

cp(2) = []; % To merge bins 2 and 3 sc = modifybins(sc,'TmWBank','CutPoints',cp); plotbins(sc,'TmWBank')

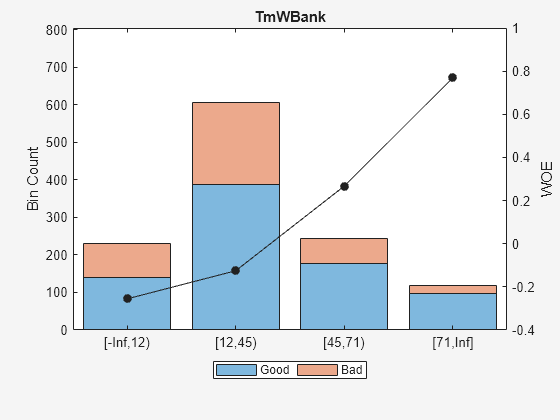

For 'AMBalance', based on the plot above, it is best to merge bins 2 and 3 because they have similar WOE's. To merge these bins:

Predictor =  'AMBalance';

[bi,cp] = bininfo(sc,Predictor)

'AMBalance';

[bi,cp] = bininfo(sc,Predictor)bi=5×6 table

Bin Good Bad Odds WOE InfoValue

_____________________ ____ ___ ______ ________ _________

{'[-Inf,558.88)' } 346 134 2.5821 0.24418 0.022795

{'[558.88,1254.28)' } 309 171 1.807 -0.11274 0.0051774

{'[1254.28,1597.44)'} 76 44 1.7273 -0.15787 0.0025554

{'[1597.44,Inf]' } 72 48 1.5 -0.29895 0.0093402

{'Totals' } 803 397 2.0227 NaN 0.039868

cp = 3×1

103 ×

0.5589

1.2543

1.5974

cp(2) = []; % To merge bins 2 and 3 sc = modifybins(sc,'AMBalance','CutPoints',cp); plotbins(sc,'AMBalance')

Now that the binning fine-tuning is completed, the bins for all predictors have close-to-linear WOE trends.

Step 3. Fit a logistic regression model.

The fitmodel function fits a logistic regression model to the WOE data. fitmodel internally bins the training data, transforms it into WOE values, maps the response variable so that 'Good' is 1, and fits a linear logistic regression model. By default, fitmodel uses a stepwise procedure to determine which predictors should be in the model.

sc = fitmodel(sc);

1. Adding CustIncome, Deviance = 1490.8954, Chi2Stat = 32.545914, PValue = 1.1640961e-08

2. Adding TmWBank, Deviance = 1467.3249, Chi2Stat = 23.570535, PValue = 1.2041739e-06

3. Adding AMBalance, Deviance = 1455.858, Chi2Stat = 11.466846, PValue = 0.00070848829

4. Adding EmpStatus, Deviance = 1447.6148, Chi2Stat = 8.2432677, PValue = 0.0040903428

5. Adding CustAge, Deviance = 1442.06, Chi2Stat = 5.5547849, PValue = 0.018430237

6. Adding ResStatus, Deviance = 1437.9435, Chi2Stat = 4.1164321, PValue = 0.042468555

7. Adding OtherCC, Deviance = 1433.7372, Chi2Stat = 4.2063597, PValue = 0.040272676

Generalized linear regression model:

logit(status) ~ 1 + CustAge + ResStatus + EmpStatus + CustIncome + TmWBank + OtherCC + AMBalance

Distribution = Binomial

Estimated Coefficients:

Estimate SE tStat pValue

________ _______ ______ __________

(Intercept) 0.7024 0.064 10.975 5.0407e-28

CustAge 0.61562 0.24783 2.4841 0.012988

ResStatus 1.3776 0.65266 2.1107 0.034799

EmpStatus 0.88592 0.29296 3.024 0.0024946

CustIncome 0.69836 0.21715 3.216 0.0013001

TmWBank 1.106 0.23266 4.7538 1.9958e-06

OtherCC 1.0933 0.52911 2.0662 0.038806

AMBalance 1.0437 0.32292 3.2322 0.0012285

1200 observations, 1192 error degrees of freedom

Dispersion: 1

Chi^2-statistic vs. constant model: 89.7, p-value = 1.42e-16

Step 4. Review and format scorecard points.

After fitting the logistic model, by default the points are unscaled and come directly from the combination of WOE values and model coefficients. The displaypoints function summarizes the scorecard points.

p1 = displaypoints(sc); disp(p1)

Predictors Bin Points

______________ ____________________ _________

{'CustAge' } {'[-Inf,37)' } -0.15314

{'CustAge' } {'[37,40)' } -0.062247

{'CustAge' } {'[40,46)' } 0.045763

{'CustAge' } {'[46,58)' } 0.22888

{'CustAge' } {'[58,Inf]' } 0.48354

{'CustAge' } {'<missing>' } NaN

{'ResStatus' } {'Tenant' } -0.031302

{'ResStatus' } {'Home Owner' } 0.12697

{'ResStatus' } {'Other' } 0.37652

{'ResStatus' } {'<missing>' } NaN

{'EmpStatus' } {'Unknown' } -0.076369

{'EmpStatus' } {'Employed' } 0.31456

{'EmpStatus' } {'<missing>' } NaN

{'CustIncome'} {'[-Inf,29000)' } -0.45455

{'CustIncome'} {'[29000,33000)' } -0.1037

{'CustIncome'} {'[33000,42000)' } 0.077768

{'CustIncome'} {'[42000,47000)' } 0.24406

{'CustIncome'} {'[47000,Inf]' } 0.43536

{'CustIncome'} {'<missing>' } NaN

{'TmWBank' } {'[-Inf,12)' } -0.18221

{'TmWBank' } {'[12,45)' } -0.038279

{'TmWBank' } {'[45,71)' } 0.39569

{'TmWBank' } {'[71,Inf]' } 0.95074

{'TmWBank' } {'<missing>' } NaN

{'OtherCC' } {'No' } -0.193

{'OtherCC' } {'Yes' } 0.15868

{'OtherCC' } {'<missing>' } NaN

{'AMBalance' } {'[-Inf,558.88)' } 0.3552

{'AMBalance' } {'[558.88,1597.44)'} -0.026797

{'AMBalance' } {'[1597.44,Inf]' } -0.21168

{'AMBalance' } {'<missing>' } NaN

This is a good time to modify the bin labels, if this is something of interest for cosmetic reasons. To do so, use modifybins to change the bin labels.

sc = modifybins(sc,'CustAge','BinLabels',... {'Up to 36' '37 to 39' '40 to 45' '46 to 57' '58 and up'}); sc = modifybins(sc,'CustIncome','BinLabels',... {'Up to 28999' '29000 to 32999' '33000 to 41999' '42000 to 46999' '47000 and up'}); sc = modifybins(sc,'TmWBank','BinLabels',... {'Up to 11' '12 to 44' '45 to 70' '71 and up'}); sc = modifybins(sc,'AMBalance','BinLabels',... {'Up to 558.87' '558.88 to 1597.43' '1597.44 and up'}); p1 = displaypoints(sc); disp(p1)

Predictors Bin Points

______________ _____________________ _________

{'CustAge' } {'Up to 36' } -0.15314

{'CustAge' } {'37 to 39' } -0.062247

{'CustAge' } {'40 to 45' } 0.045763

{'CustAge' } {'46 to 57' } 0.22888

{'CustAge' } {'58 and up' } 0.48354

{'CustAge' } {'<missing>' } NaN

{'ResStatus' } {'Tenant' } -0.031302

{'ResStatus' } {'Home Owner' } 0.12697

{'ResStatus' } {'Other' } 0.37652

{'ResStatus' } {'<missing>' } NaN

{'EmpStatus' } {'Unknown' } -0.076369

{'EmpStatus' } {'Employed' } 0.31456

{'EmpStatus' } {'<missing>' } NaN

{'CustIncome'} {'Up to 28999' } -0.45455

{'CustIncome'} {'29000 to 32999' } -0.1037

{'CustIncome'} {'33000 to 41999' } 0.077768

{'CustIncome'} {'42000 to 46999' } 0.24406

{'CustIncome'} {'47000 and up' } 0.43536

{'CustIncome'} {'<missing>' } NaN

{'TmWBank' } {'Up to 11' } -0.18221

{'TmWBank' } {'12 to 44' } -0.038279

{'TmWBank' } {'45 to 70' } 0.39569

{'TmWBank' } {'71 and up' } 0.95074

{'TmWBank' } {'<missing>' } NaN

{'OtherCC' } {'No' } -0.193

{'OtherCC' } {'Yes' } 0.15868

{'OtherCC' } {'<missing>' } NaN

{'AMBalance' } {'Up to 558.87' } 0.3552

{'AMBalance' } {'558.88 to 1597.43'} -0.026797

{'AMBalance' } {'1597.44 and up' } -0.21168

{'AMBalance' } {'<missing>' } NaN

Points are usually scaled and also often rounded. To do this, use the formatpoints function. For example, you can set a target level of points corresponding to a target odds level and also set the required points-to-double-the-odds (PDO).

TargetPoints = 500; TargetOdds = 2; PDO = 50; % Points to double the odds sc = formatpoints(sc,'PointsOddsAndPDO',[TargetPoints TargetOdds PDO]); p2 = displaypoints(sc); disp(p2)

Predictors Bin Points

______________ _____________________ ______

{'CustAge' } {'Up to 36' } 53.239

{'CustAge' } {'37 to 39' } 59.796

{'CustAge' } {'40 to 45' } 67.587

{'CustAge' } {'46 to 57' } 80.796

{'CustAge' } {'58 and up' } 99.166

{'CustAge' } {'<missing>' } NaN

{'ResStatus' } {'Tenant' } 62.028

{'ResStatus' } {'Home Owner' } 73.445

{'ResStatus' } {'Other' } 91.446

{'ResStatus' } {'<missing>' } NaN

{'EmpStatus' } {'Unknown' } 58.777

{'EmpStatus' } {'Employed' } 86.976

{'EmpStatus' } {'<missing>' } NaN

{'CustIncome'} {'Up to 28999' } 31.497

{'CustIncome'} {'29000 to 32999' } 56.805

{'CustIncome'} {'33000 to 41999' } 69.896

{'CustIncome'} {'42000 to 46999' } 81.891

{'CustIncome'} {'47000 and up' } 95.69

{'CustIncome'} {'<missing>' } NaN

{'TmWBank' } {'Up to 11' } 51.142

{'TmWBank' } {'12 to 44' } 61.524

{'TmWBank' } {'45 to 70' } 92.829

{'TmWBank' } {'71 and up' } 132.87

{'TmWBank' } {'<missing>' } NaN

{'OtherCC' } {'No' } 50.364

{'OtherCC' } {'Yes' } 75.732

{'OtherCC' } {'<missing>' } NaN

{'AMBalance' } {'Up to 558.87' } 89.908

{'AMBalance' } {'558.88 to 1597.43'} 62.353

{'AMBalance' } {'1597.44 and up' } 49.016

{'AMBalance' } {'<missing>' } NaN

Step 5. Score the data.

The score function computes the scores for the training data. An optional data input can also be passed to score, for example, validation data. The points per predictor for each customer are provided as an optional output.

[Scores,Points] = score(sc); disp(Scores(1:10))

528.2044 554.8861 505.2406 564.0717 554.8861 586.1904 441.8755 515.8125 524.4553 508.3169

disp(Points(1:10,:))

CustAge ResStatus EmpStatus CustIncome TmWBank OtherCC AMBalance

_______ _________ _________ __________ _______ _______ _________

80.796 62.028 58.777 95.69 92.829 75.732 62.353

99.166 73.445 86.976 95.69 61.524 75.732 62.353

80.796 62.028 86.976 69.896 92.829 50.364 62.353

80.796 73.445 86.976 95.69 61.524 75.732 89.908

99.166 73.445 86.976 95.69 61.524 75.732 62.353

99.166 73.445 86.976 95.69 92.829 75.732 62.353

53.239 73.445 58.777 56.805 61.524 75.732 62.353

80.796 91.446 86.976 95.69 61.524 50.364 49.016

80.796 62.028 58.777 95.69 61.524 75.732 89.908

80.796 73.445 58.777 95.69 61.524 75.732 62.353

Step 6. Calculate the probability of default.

To calculate the probability of default, use the probdefault function.

pd = probdefault(sc);

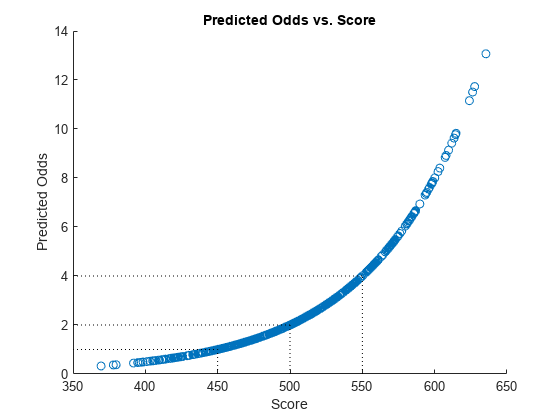

Define the probability of being “Good” and plot the predicted odds versus the formatted scores. Visually analyze that the target points and target odds match and that the points-to-double-the-odds (PDO) relationship holds.

ProbGood = 1-pd; PredictedOdds = ProbGood./pd; figure scatter(Scores,PredictedOdds) title('Predicted Odds vs. Score') xlabel('Score') ylabel('Predicted Odds') hold on xLimits = xlim; yLimits = ylim; % Target points and odds plot([TargetPoints TargetPoints],[yLimits(1) TargetOdds],'k:') plot([xLimits(1) TargetPoints],[TargetOdds TargetOdds],'k:') % Target points plus PDO plot([TargetPoints+PDO TargetPoints+PDO],[yLimits(1) 2*TargetOdds],'k:') plot([xLimits(1) TargetPoints+PDO],[2*TargetOdds 2*TargetOdds],'k:') % Target points minus PDO plot([TargetPoints-PDO TargetPoints-PDO],[yLimits(1) TargetOdds/2],'k:') plot([xLimits(1) TargetPoints-PDO],[TargetOdds/2 TargetOdds/2],'k:') hold off

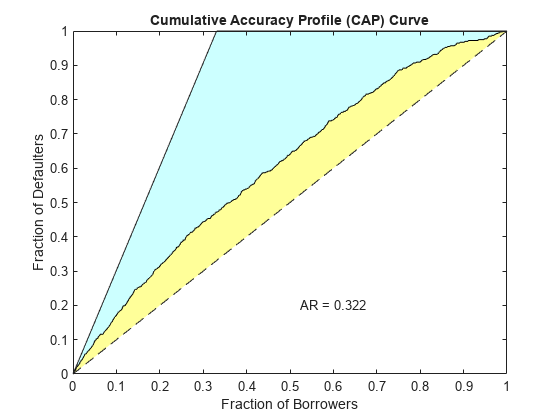

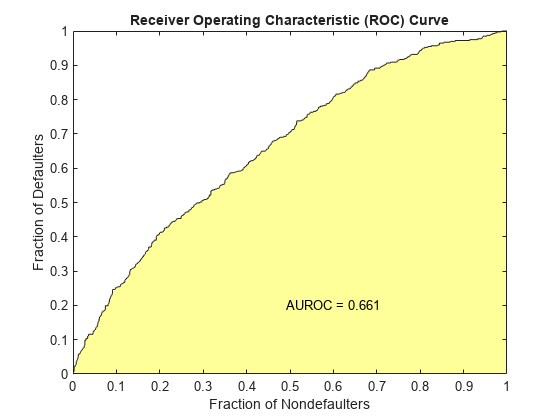

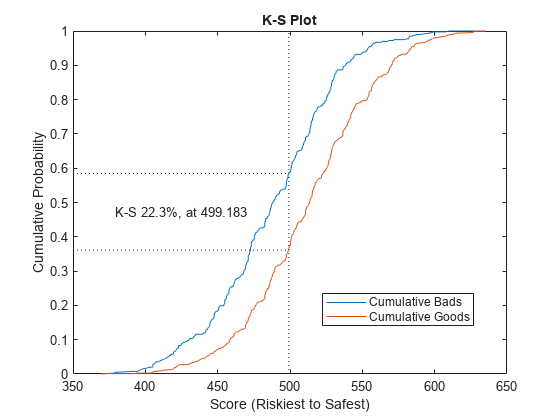

Step 7. Validate the credit scorecard model using the CAP, ROC, and Kolmogorov-Smirnov statistic

The creditscorecard class supports three validation methods, the Cumulative Accuracy Profile (CAP), the Receiver Operating Characteristic (ROC), and the Kolmogorov-Smirnov (KS) statistic. For more information on CAP, ROC, and KS, see Cumulative Accuracy Profile (CAP), Receiver Operating Characteristic (ROC), and Kolmogorov-Smirnov statistic (KS).

[Stats,T] = validatemodel(sc,'Plot',{'CAP','ROC','KS'});

disp(Stats)

Measure Value

________________________ _______

{'Accuracy Ratio' } 0.32225

{'Area under ROC curve'} 0.66113

{'KS statistic' } 0.22324

{'KS score' } 499.18

disp(T(1:15,:))

Scores ProbDefault TrueBads FalseBads TrueGoods FalseGoods Sensitivity FalseAlarm PctObs

______ ___________ ________ _________ _________ __________ ___________ __________ __________

369.4 0.7535 0 1 802 397 0 0.0012453 0.00083333

377.86 0.73107 1 1 802 396 0.0025189 0.0012453 0.0016667

379.78 0.7258 2 1 802 395 0.0050378 0.0012453 0.0025

391.81 0.69139 3 1 802 394 0.0075567 0.0012453 0.0033333

394.77 0.68259 3 2 801 394 0.0075567 0.0024907 0.0041667

395.78 0.67954 4 2 801 393 0.010076 0.0024907 0.005

396.95 0.67598 5 2 801 392 0.012594 0.0024907 0.0058333

398.37 0.67167 6 2 801 391 0.015113 0.0024907 0.0066667

401.26 0.66276 7 2 801 390 0.017632 0.0024907 0.0075

403.23 0.65664 8 2 801 389 0.020151 0.0024907 0.0083333

405.09 0.65081 8 3 800 389 0.020151 0.003736 0.0091667

405.15 0.65062 11 5 798 386 0.027708 0.0062267 0.013333

405.37 0.64991 11 6 797 386 0.027708 0.007472 0.014167

406.18 0.64735 12 6 797 385 0.030227 0.007472 0.015

407.14 0.64433 13 6 797 384 0.032746 0.007472 0.015833

Step 8. Validate at Decile Level

In step 7, the validatemodel function uses the default 'AnalysisLevel' at the individual score level. Now consider using the validatemodel function with 'decile' level validation statistics.

[Stats,T] = validatemodel(sc,'AnalysisLevel','deciles'); disp(Stats)

Measure Value

________________________ _______

{'Accuracy Ratio' } 0.31659

{'Area under ROC curve'} 0.6583

{'KS statistic' } 0.21543

{'KS score' } 482.52

disp(T)

Scores ProbDefault TrueBads FalseBads TrueGoods FalseGoods Sensitivity FalseAlarm PctObs

______ ___________ ________ _________ _________ __________ ___________ __________ _______

447.51 0.57922 68 52 751 329 0.17128 0.064757 0.1

469.34 0.4678 125 115 688 272 0.31486 0.14321 0.2

482.52 0.41453 176 183 620 221 0.44332 0.2279 0.29917

496.7 0.37202 214 265 538 183 0.53904 0.33001 0.39917

504.49 0.33294 254 345 458 143 0.6398 0.42964 0.49917

515.51 0.29986 294 426 377 103 0.74055 0.53051 0.6

528.08 0.2691 330 510 293 67 0.83123 0.63512 0.7

541.38 0.23827 361 599 204 36 0.90932 0.74595 0.8

563.16 0.19765 384 696 107 13 0.96725 0.86675 0.9

635.41 0.13789 397 803 0 0 1 1 1

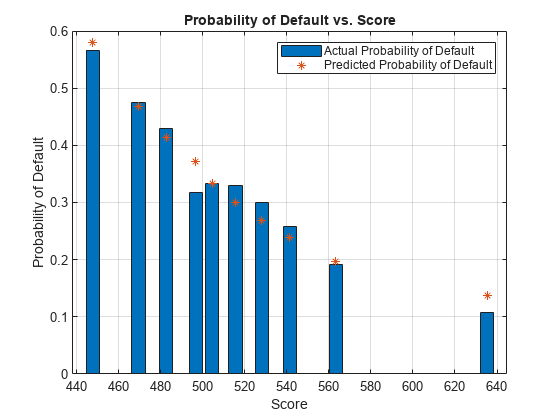

You can use the validation statistics to display the actual and predicted probabilities of default at the decile level.

% The TrueBads and FalseBads columns contain cumulative data bads = diff([0;T.TrueBads]); goods = diff([0;T.FalseBads]); obsPD = bads./(bads+goods); predPD = T.ProbDefault; bar(T.Scores,obsPD) hold on scatter(T.Scores,predPD,'*') xlabel('Score') ylabel('Probability of Default') title('Probability of Default vs. Score') grid legend('Actual Probability of Default', 'Predicted Probability of Default') hold off

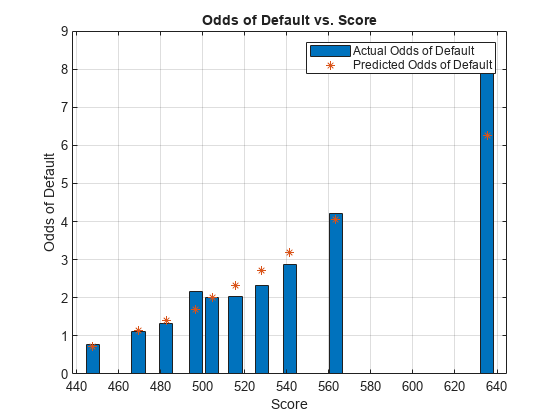

Similarly, you can consider the actual and predicted odds of default.

obsOdds = (1-obsPD)./obsPD; predOdds = (1-predPD)./predPD; bar(T.Scores,obsOdds) hold on scatter(T.Scores,predOdds,'*') xlabel('Score') ylabel('Odds of Default') title('Odds of Default vs. Score') grid legend('Actual Odds of Default', 'Predicted Odds of Default') hold off

Finally, compute the Hosmer-Lemeshow statistic. Recall that the null hypothesis of the Hosmer-Lemeshow test is that the actual (observed) and predicted (expected) probability of default is the same. Thus, a small p-value that rejects the null hypothesis is an indicator of a poor model fit.

N = bads+goods; obsBads = bads; expBads = predPD.*N; HLStatistic = sum((obsBads-expBads).^2./(N.*predPD.*(1-predPD))); % 8 degrees of freedom = 10 (deciles) - 2 pHL = chi2cdf(HLStatistic,8,'upper')

pHL = 0.8503

See Also

creditscorecard | autobinning | bininfo | predictorinfo | modifypredictor | modifybins | bindata | plotbins | fitmodel | displaypoints | formatpoints | score | setmodel | probdefault | validatemodel | compact

Topics

- Troubleshooting Credit Scorecard Results

- Credit Rating by Bagging Decision Trees

- About Credit Scorecards

- Credit Scorecard Modeling Workflow

- Credit Scorecard Modeling Using Observation Weights

- Monotone Adjacent Pooling Algorithm (MAPA)