fitConstrainedModel

Fit logistic regression model to Weight of Evidence (WOE) data subject to constraints on model coefficients

Description

[

fits a logistic regression model to the Weight of Evidence (WOE) data subject to

equality, inequality, or bound constraints on the model coefficients.

sc,mdl] = fitConstrainedModel(sc)fitConstrainedModel stores the model predictor names and

corresponding coefficients in an updated creditscorecard

object sc and returns the

GeneralizedLinearModel object mdl

which contains the fitted model.

[

specifies options using one or more name-value pair arguments in addition to the

input arguments in the previous syntax.sc,mdl]

= fitConstrainedModel(___,Name,Value)

Examples

To compute scores for a creditscorecard object with constraints for equality, inequality, or bounds on the coefficients of the logistic regression model, use fitConstrainedModel. Unlike fitmodel, fitConstrainedModel solves for both the unconstrained and constrained problem. The current solver used to minimize an objective function for fitConstrainedModel is fmincon, from the Optimization Toolbox™.

This example has three main sections. First, fitConstrainedModel is used to solve for the coefficients in the unconstrained model. Then, fitConstrainedModel demonstrates how to use several types of constraints. Finally, fitConstrainedModel uses bootstrapping for the significance analysis to determine which predictors to reject from the model.

Create the creditscorecard Object and Bin data

load CreditCardData.mat sc = creditscorecard(data,'IDVar','CustID'); sc = autobinning(sc);

Unconstrained Model Using fitConstrainedModel

Solve for the unconstrained coefficients using fitConstrainedModel with default values for the input parameters. fitConstrainedModel uses the internal optimization solver fmincon from the Optimization Toolbox™. If you do not set any constraints, fmincon treats the model as an unconstrained optimization problem. The default parameters for the LowerBound and UpperBound are -Inf and +Inf, respectively. For the equality and inequality constraints, the default is an empty numeric array.

[sc1,mdl1] = fitConstrainedModel(sc); coeff1 = mdl1.Coefficients.Estimate; disp(mdl1.Coefficients);

Estimate

_________

(Intercept) 0.70246

CustAge 0.6057

TmAtAddress 1.0381

ResStatus 1.3794

EmpStatus 0.89648

CustIncome 0.70179

TmWBank 1.1132

OtherCC 1.0598

AMBalance 1.0572

UtilRate -0.047597

Unlike fitmodel which gives p-values, when using fitConstrainedModel, you must use bootstrapping to find out which predictors are rejected from the model, when subject to constraints. This is illustrated in the "Significance Bootstrapping" section.

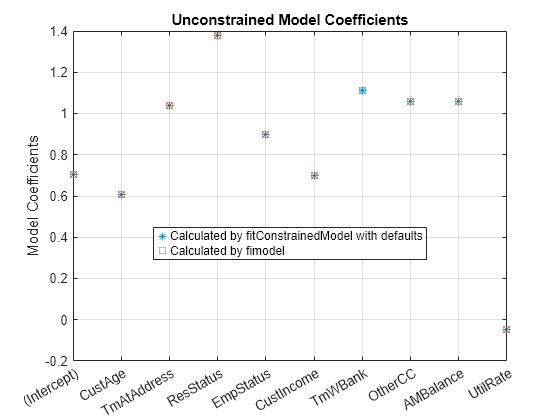

Using fitmodel to Compare the Results and Calibrate the Model

fitmodel fits a logistic regression model to the Weight-of-Evidence (WOE) data and there are no constraints. You can compare the results from the "Unconstrained Model Using fitConstrainedModel" section with those of fitmodel to verify that the model is well calibrated.

Now, solve the unconstrained problem by using fitmodel. Note that fitmodel and fitConstrainedModel use different solvers. While fitConstrainedModel uses fmincon, fitmodel uses stepwiseglm by default. To include all predictors from the start, set the 'VariableSelection' name-value pair argument of fitmodel to 'fullmodel'.

[sc2,mdl2] = fitmodel(sc,'VariableSelection','fullmodel','Display','off'); coeff2 = mdl2.Coefficients.Estimate; disp(mdl2.Coefficients);

Estimate SE tStat pValue

_________ ________ _________ __________

(Intercept) 0.70246 0.064039 10.969 5.3719e-28

CustAge 0.6057 0.24934 2.4292 0.015131

TmAtAddress 1.0381 0.94042 1.1039 0.26963

ResStatus 1.3794 0.6526 2.1137 0.034538

EmpStatus 0.89648 0.29339 3.0556 0.0022458

CustIncome 0.70179 0.21866 3.2095 0.0013295

TmWBank 1.1132 0.23346 4.7683 1.8579e-06

OtherCC 1.0598 0.53005 1.9994 0.045568

AMBalance 1.0572 0.36601 2.8884 0.0038718

UtilRate -0.047597 0.61133 -0.077858 0.93794

figure plot(coeff1,'*') hold on plot(coeff2,'s') xticklabels(mdl1.Coefficients.Properties.RowNames) ylabel('Model Coefficients') title('Unconstrained Model Coefficients') legend({'Calculated by fitConstrainedModel with defaults','Calculated by fimodel'},'Location','best') grid on

As both the tables and the plot show, the model coefficients match. You can be confident that this implementation of fitConstrainedModel is well calibrated.

Constrained Model

In the constrained model approach, you solve for the values of the coefficients of the logistic model, subject to constraints. The supported constraints are bound, equality, or inequality. The coefficients maximize the likelihood-of-default function defined, for observation , as:

where:

is an unknown model coefficient

is the predictor values at observation

is the response value; a value of 1 represents default and a value of 0 represents non-default

This formula is for non-weighted data. When observation i has weight , it means that there are as many observations i. Therefore, the probability that default occurs at observation i is the product of the probabilities of default:

Likewise, the probability of non-default for weighted observation i is:

For weighted data, if there is default at a given observation i whose weight is , it is as if there was a count of that one observation, and all of them either all default, or all non-default. may or may not be an integer.

Therefore, for the weighted data, the likelihood-of-default function for observation i in the first equation becomes

By assumption, all defaults are independent events, so the objective function is

or, in more convenient logarithmic terms:

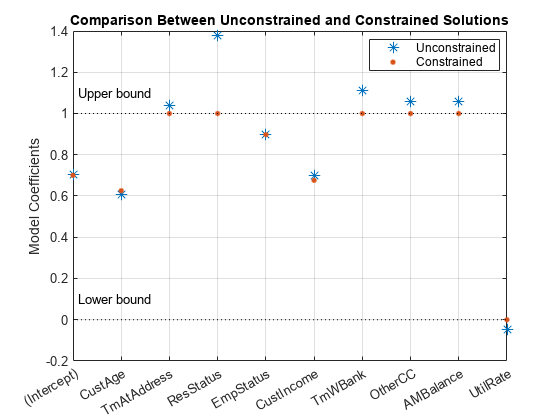

Apply Constraints on the Coefficients

After calibrating the unconstrained model as described in the "Unconstrained Model Using fitConstrainedModel" section, you can solve for the model coefficients subject to constraints. You can choose lower and upper bounds such that , except for the intercept. Also, since the customer age and customer income are somewhat correlated, you can also use additional constraints on their coefficients, for example, . The coefficients corresponding to the predictors 'CustAge' and 'CustIncome' in this example are and , respectively.

K = length(sc.PredictorVars); lb = [-Inf;zeros(K,1)]; ub = [Inf;ones(K,1)]; AIneq = [0 -1 0 0 0 1 0 0 0 0;0 -1 0 0 0 -1 0 0 0 0]; bIneq = [0.05;0.05]; Options = optimoptions('fmincon','SpecifyObjectiveGradient',true,'Display','off'); [sc3,mdl] = fitConstrainedModel(sc,'AInequality',AIneq,'bInequality',bIneq,... 'LowerBound',lb,'UpperBound',ub,'Options',Options); figure plot(coeff1,'*','MarkerSize',8) hold on plot(mdl.Coefficients.Estimate,'.','MarkerSize',12) line(xlim,[0 0],'color','k','linestyle',':') line(xlim,[1 1],'color','k','linestyle',':') text(1.1,0.1,'Lower bound') text(1.1,1.1,'Upper bound') grid on xticklabels(mdl.Coefficients.Properties.RowNames) ylabel('Model Coefficients') title('Comparison Between Unconstrained and Constrained Solutions') legend({'Unconstrained','Constrained'},'Location','best')

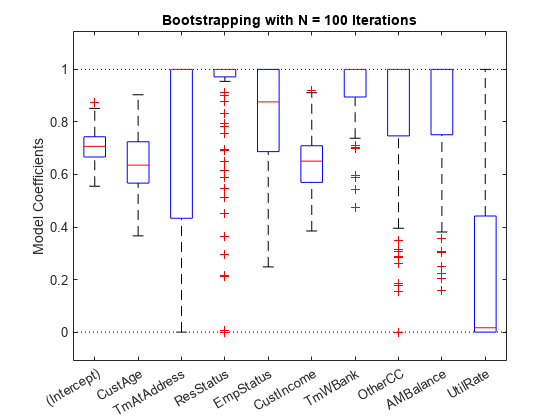

Significance Bootstrapping

For the unconstrained problem, standard formulas are available for computing p-values, which you use to evaluate which coefficients are significant and which are to be rejected. However, for the constrained problem, standard formulas are not available, and the derivation of formulas for significance analysis is complicated. A practical alternative is to perform significance analysis through bootstrapping.

In the bootstrapping approach, when using fitConstrainedModel, you set the name-value argument 'Bootstrap' to true and chose a value for the name-value argument 'BootstrapIter'. Bootstrapping means that samples (with replacement) from the original observations are selected. In each iteration, fitConstrainedModel solves for the same constrained problem as the "Constrained Model" section. fitConstrainedModel obtains several values (solutions) for each coefficient and you can plot these as a boxplot or histogram. Using the boxplot or histogram, you can examine the median values to evaluate whether the coefficients are away from zero and how much the coefficients deviate from their means.

lb = [-Inf;zeros(K,1)]; ub = [Inf;ones(K,1)]; AIneq = [0 -1 0 0 0 1 0 0 0 0;0 1 0 0 0 -1 0 0 0 0]; bIneq = [0.05;0.05]; c0 = zeros(K,1); NIter = 100; Options = optimoptions('fmincon','SpecifyObjectiveGradient',true,'Display','off'); rng('default') [sc,mdl] = fitConstrainedModel(sc,'AInequality',AIneq,'bInequality',bIneq,... 'LowerBound',lb,'UpperBound',ub,'Bootstrap',true,'BootstrapIter',NIter,'Options',Options); figure boxplot(mdl.Bootstrap.Matrix,mdl.Coefficients.Properties.RowNames) hold on line(xlim,[0 0],'color','k','linestyle',':') line(xlim,[1 1],'color','k','linestyle',':') title('Bootstrapping with N = 100 Iterations') ylabel('Model Coefficients')

The solid red lines in the boxplot indicate that the median values and the bottom and top edges are for the and percentiles. The "whiskers" are the minimum and maximum values, not including outliers. The dotted lines represent the lower and upper bound constraints on the coefficients. In this example, the coefficients cannot be negative, by construction.

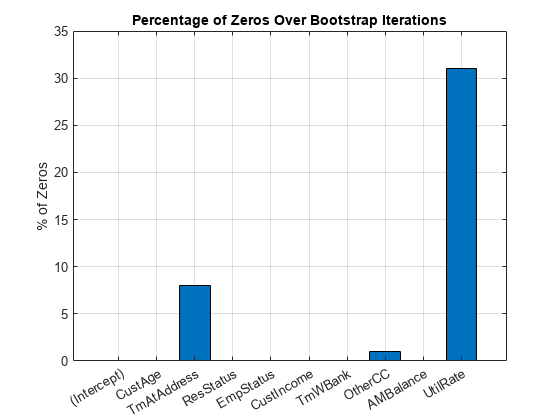

To help decide which predictors to keep in the model, assess the proportion of times each coefficient is zero.

Tol = 1e-6; figure bar(100*sum(mdl.Bootstrap.Matrix<= Tol)/NIter) ylabel('% of Zeros') title('Percentage of Zeros Over Bootstrap Iterations') xticklabels(mdl.Coefficients.Properties.RowNames) grid on

Based on the plot, you can reject 'UtilRate' since it has the highest number of zero values. You can also decide to reject 'TmAtAddress' since it shows a peak, albeit small.

Set the Corresponding Coefficients to Zero

To set the corresponding coefficients to zero, set their upper bound to zero and solve the model again using the original data set.

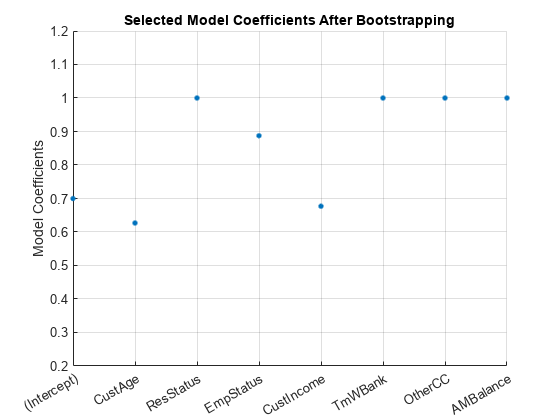

ub(3) = 0; ub(end) = 0; [sc,mdl] = fitConstrainedModel(sc,'AInequality',AIneq,'bInequality',bIneq,'LowerBound',lb,'UpperBound',ub,'Options',Options); Ind = (abs(mdl.Coefficients.Estimate) <= Tol); ModelCoeff = mdl.Coefficients.Estimate(~Ind); ModelPreds = mdl.Coefficients.Properties.RowNames(~Ind)'; figure hold on plot(ModelCoeff,'.','MarkerSize',12) ylim([0.2 1.2]) ylabel('Model Coefficients') xticklabels(ModelPreds) title('Selected Model Coefficients After Bootstrapping') grid on

Set Constrained Coefficients Back Into the creditscorecard

Now that you have solved for the constrained coefficients, use setmodel to set the model's coefficients and predictors. Then you can compute the (unscaled) points.

ModelPreds = ModelPreds(2:end); sc = setmodel(sc,ModelPreds,ModelCoeff); p = displaypoints(sc); disp(p)

Predictors Bin Points

______________ _____________________ _________

{'CustAge' } {'[-Inf,33)' } -0.16725

{'CustAge' } {'[33,37)' } -0.14811

{'CustAge' } {'[37,40)' } -0.065607

{'CustAge' } {'[40,46)' } 0.044404

{'CustAge' } {'[46,48)' } 0.21761

{'CustAge' } {'[48,58)' } 0.23404

{'CustAge' } {'[58,Inf]' } 0.49029

{'CustAge' } {'<missing>' } NaN

{'ResStatus' } {'Tenant' } 0.0044307

{'ResStatus' } {'Home Owner' } 0.11932

{'ResStatus' } {'Other' } 0.30048

{'ResStatus' } {'<missing>' } NaN

{'EmpStatus' } {'Unknown' } -0.077028

{'EmpStatus' } {'Employed' } 0.31459

{'EmpStatus' } {'<missing>' } NaN

{'CustIncome'} {'[-Inf,29000)' } -0.43795

{'CustIncome'} {'[29000,33000)' } -0.097814

{'CustIncome'} {'[33000,35000)' } 0.053667

{'CustIncome'} {'[35000,40000)' } 0.081921

{'CustIncome'} {'[40000,42000)' } 0.092364

{'CustIncome'} {'[42000,47000)' } 0.23932

{'CustIncome'} {'[47000,Inf]' } 0.42477

{'CustIncome'} {'<missing>' } NaN

{'TmWBank' } {'[-Inf,12)' } -0.15547

{'TmWBank' } {'[12,23)' } -0.031077

{'TmWBank' } {'[23,45)' } -0.021091

{'TmWBank' } {'[45,71)' } 0.36703

{'TmWBank' } {'[71,Inf]' } 0.86888

{'TmWBank' } {'<missing>' } NaN

{'OtherCC' } {'No' } -0.16832

{'OtherCC' } {'Yes' } 0.15336

{'OtherCC' } {'<missing>' } NaN

{'AMBalance' } {'[-Inf,558.88)' } 0.34418

{'AMBalance' } {'[558.88,1254.28)' } -0.012745

{'AMBalance' } {'[1254.28,1597.44)'} -0.057879

{'AMBalance' } {'[1597.44,Inf]' } -0.19896

{'AMBalance' } {'<missing>' } NaN

Using the unscaled points, you can follow the remainder of the Credit Scorecard Modeling Workflow to compute scores and probabilities of default and to validate the model.

Input Arguments

Credit scorecard model, specified as a creditscorecard

object. Use creditscorecard to create a

creditscorecard object.

Name-Value Arguments

Specify optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where Name is

the argument name and Value is the corresponding value.

Name-value arguments must appear after other arguments, but the order of the

pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

Example: [sc,mdl] =

fitConstrainedModel(sc,'LowerBound',2,'UpperBound',100)

Predictor variables for fitting the creditscorecard

object, specified as the comma-separated pair consisting of

'PredictorVars' and a cell array of character

vectors. If you provide predictor variables, then the function updates

the creditscorecard object

property PredictorsVars. The order of predictors in

the original dataset is enforced, regardless of the order in which

'PredictorVars' is provided. When not provided,

the predictors used to create the creditscorecard

object (by using creditscorecard) are

used.

Data Types: cell

Lower bound, specified as the comma-separated pair consisting of

'LowerBound' and a scalar or a real vector of

length N+1, where

N is the number of model coefficients in the

creditscorecard object.

Data Types: double

Upper bound, specified as the comma-separated pair consisting of

'UpperBound' and a scalar or a real vector of

length N+1, where

N is the number of model coefficients in the

creditscorecard object.

Data Types: double

Matrix of linear inequality constraints, specified as the

comma-separated pair consisting of 'AInequality' and

a real M-by-N+1

matrix, where M is the number of constraints and

N is the number of model coefficients in the

creditscorecard object.

Data Types: double

Vector of linear inequality constraints, specified as the

comma-separated pair consisting of 'bInequality' and

a real M-by-1 vector, where

M is the number of constraints.

Data Types: double

Matrix of linear equality constraints, specified as the

comma-separated pair consisting of 'AEquality' and a

real M-by-N+1

matrix, where M is the number of constraints and

N is the number of model coefficients in the

creditscorecard object.

Data Types: double

Vector of linear equality constraints, specified as the

comma-separated pair consisting of 'bEquality' and a

real M-by-1 vector, where

M is the number of constraints.

Data Types: double

Indicator that bootstrapping defines the solution accuracy, specified

as the comma-separated pair consisting of 'Bootstrap'

and a logical with a value of true or

false.

Data Types: logical

Number of bootstrapping iterations, specified as the comma-separated

pair consisting of 'BootstrapIter' and a positive

integer.

Data Types: double

optimoptions object, specified as the

comma-separated pair consisting of 'Options' and an

optimoptions object. You can create the object by

using optimoptions from

Optimization Toolbox™.

Data Types: object

Output Arguments

Credit scorecard model, returned as an updated

creditscorecard object. The

creditscorecard object contains information about the

model predictors and coefficients that fit the WOE data. For more

information on using the creditscorecard object, see

creditscorecard.

Fitted logistic model, returned as a

GeneralizedLinearModel object containing the fitted

model. For more information on a GeneralizedLinearModel

object, see GeneralizedLinearModel.

Note

If you specify the optional WeightsVar argument

when creating a creditscorecard

object, then mdl uses the weighted counts with

stepwiseglm and

fitglm.

The mdl structure has the following fields:

Coefficientsis a table in which theRowNamesproperty contains the names of the model coefficients and has a single column,'Estimate', containing the solution.Bootstrapexists when'Bootstrap'is set totrue, and has two fields:CIcontains the 95% confidence interval for the solution.

MatrixanNIter-by-Nmatrix of coefficients, whereNIter is the number of bootstrap iterations andNis the number of model coefficients.

Solverhas three fields:Optionsadditional information on the algorithm and solution.ExitFlagcontains an integer that codes the reason why the solver stopped. For more information, seefmincon.Outputis a structure with additional information on the optimization process.

More About

When you use fitConstrainedModel to solve for

the model coefficients, the function solves for the same number of parameters as

predictor variables you specify, plus one additional coefficient for the

intercept.

The first coefficient corresponds to the intercept. If you provide predictor

variables using the 'PredictorVars' optional input argument,

then fitConstrainedModel updates the creditscorecard object property

PredictorsVars. The order of predictors in the original

dataset is enforced, regardless of the order in which

'PredictorVars' is provided. When not provided, the

predictors used to create the creditscorecard object (by using

creditscorecard) are used.

The constrained model is first calibrated such that, when

unconstrained, the solution is identical, within a certain tolerance, to the

solution given by fitmodel, with

the'fullmodel' choice for the name-value argument

'VariableSelection'.

As an exercise, you can test the calibration by leaving all name-value parameters

of fitConstrainedModel to their default values. The solutions

are identical to within a 10-6 to

10-5 tolerance.

If the credit scorecard data contains

observation weights, the fitConstrainedModel function uses the

weights to calibrate the model coefficients.

For credit scorecard data with no missing data and no weights,

the likelihood function for observation i is

where:

b = [b1 b2...bK] is for unknown model coefficients

xi = [xi1 xi2...xiK] is the predictor values at observation i

yi is the response value of

1(the default) or a value of0.

When observation i has weight wi, it means that there are wi observations. Because of the independence of defaults between observations, the probability that there is default at observation i is the product of the probabilities of default

Likewise, the probability of non-default for weighted observation i is

For weighted data, if there is default at a given observation i whose weight is wi, it is as if there was wi defaults of that one observation, and all of them either all default, or all non-default. wi may or may not be an integer. Therefore, the likelihood function for observation i becomes

Likewise, for data with missing observations (NaN,

<undefined>, or “Missing”), the model

is calibrated by comparing the unconstrained case with results given by fitglm. Where the data contains missing observations, the WOE input

matrix has NaN values. The NaN values do not

pose any issue for fitglm (unconstrained), or fmincon (constrained). The only edge case is if all observations of

a given predictor are missing, in which case, that predictor is discarded from the

model.

Bootstrapping is a method for estimating the accuracy of the

solution obtained after iterating the objective function NIter

times.

When 'Bootstrap' is set to true, the

fitConstrainedModel function performs sampling with

replacement of the WOE values and is passed to the objective function. At the end of

the iterative process, the solutions are stored in a

NIter-by-N+1 matrix,

where N is the number of model coefficients.

The 95% confidence interval (CI) returned in the output structure

mdl.Bootstrap contains the values of the coefficients at the

25th and 97.5th percentiles.

A logistic regression model is used in the

creditscorecard object.

For the model, the probability of being “Bad” is given by

ProbBad = exp(-s) / (1 + exp(-s)).

References

[1] Anderson, R. The Credit Scoring Toolkit. Oxford University Press, 2007.

[2] Refaat, M. Credit Risk Scorecards: Development and Implementation Using SAS. lulu.com, 2011.

Version History

Introduced in R2019a

See Also

fitmodel | creditscorecard | autobinning | bininfo | predictorinfo | modifypredictor | plotbins | modifybins | bindata | displaypoints | formatpoints | score | stepwiseglm | fitglm | fmincon | setmodel | probdefault | validatemodel | GeneralizedLinearModel

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

选择网站

选择网站以获取翻译的可用内容,以及查看当地活动和优惠。根据您的位置,我们建议您选择:。

您也可以从以下列表中选择网站:

如何获得最佳网站性能

选择中国网站(中文或英文)以获得最佳网站性能。其他 MathWorks 国家/地区网站并未针对您所在位置的访问进行优化。

美洲

- América Latina (Español)

- Canada (English)

- United States (English)

欧洲

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)