pcgcomp

Linear inequalities for asset group comparison constraints

Description

As an alternative to pcgcomp, use the Portfolio object

(Portfolio) for mean-variance portfolio

optimization. This object supports gross or net portfolio returns as the return proxy,

the variance of portfolio returns as the risk proxy, and a portfolio set that is any

combination of the specified constraints to form a portfolio set. For information on the

workflow when using Portfolio objects, see Portfolio Object Workflow.

[

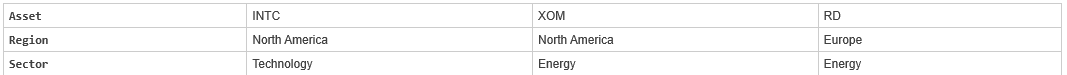

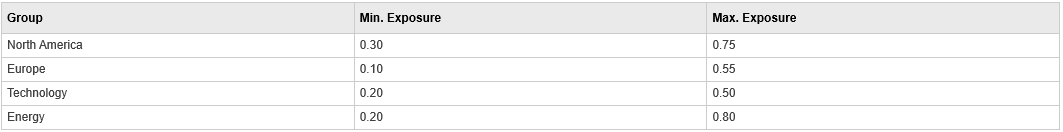

specifies that the ratio of allocations in one group to allocations in another group

is at least A,b] = pcgcomp(GroupA,AtoBmin,AtoBmax,GroupB)AtoBmin to 1 and at most

AtoBmax to 1. Comparisons can be made

between an arbitrary number of group pairs NGROUPS comprising

subsets of NASSETS available investments.

If pcgcomp is called with fewer than two output arguments, the

function returns A concatenated with b

[A,b].

Examples

Input Arguments

Output Arguments

Version History

Introduced before R2006a