Portfolio

创建 Portfolio 对象以进行均值-方差投资组合优化和分析

说明

使用 Portfolio 函数创建一个 Portfolio 对象,用于均值-方差投资组合优化。

投资组合优化的主要工作流是创建一个 Portfolio 对象实例来完整指定一个投资组合优化问题,并使用支持的函数对 Portfolio 对象进行运算,以求取和分析有效投资组合。有关此工作流的详细信息,请参阅 Portfolio 对象工作流。

您可通过几种方式使用 Portfolio 对象。要使用 Portfolio 对象创建投资组合优化问题,最简单的语法是:

p = Portfolio;

Portfolio 对象 p,其中所有对象属性都为空。 Portfolio 对象也接受用一系列名称-值对组参量指定属性及其值。Portfolio 对象接受采用以下一般语法的输入作为属性:

p = Portfolio('property1',value1,'property2',value2, ... );如果已有 Portfolio 对象,则该语法允许且仅允许 Portfolio 对象的第一个参量为已有对象,后续名称-值对组参量则表示要添加或修改的属性。例如,假定已有 Portfolio 对象 p,一般语法为:

p = Portfolio(p,'property1',value1,'property2',value2, ... );

输入参量名称不区分大小写,但必须完整指定。此外,部分属性可采用简写参量名称指定(请参阅 简写属性名称)。Portfolio 对象会尝试从输入中检测问题的维度,一旦确定,则对后续输入进行各种标量或矩阵扩展运算,从而简化构建问题的整个过程。此外,Portfolio 对象是值对象,因此,假定有投资组合 p,则以下代码将创建一个不同于 p 的新对象 q:

q = Portfolio(p, ...)

创建 Portfolio 对象后,您可以使用关联的对象函数来设置投资组合约束,分析有效边界并验证投资组合模型。

有关均值-方差优化理论基础的详细信息,请参阅 投资组合优化理论。

创建对象

描述

p = PortfolioPortfolio 对象,用于均值-方差投资组合优化和分析。然后,您可以使用支持的 "add" 和 "set" 函数将元素添加到 Portfolio 对象。有关详细信息,请参阅创建 Portfolio 对象。

输入参量

输出参量

属性

对象函数

setAssetList | Set up list of identifiers for assets |

setInitPort | Set up initial or current portfolio |

setDefaultConstraints | 使用总和为 1 的非负权重设置投资组合约束 |

getAssetMoments | 从 Portfolio 对象获取资产收益的均值和协方差 |

setAssetMoments | 设置 Portfolio 对象资产收益的矩(均值和协方差) |

estimateAssetMoments | Estimate mean and covariance of asset returns from data |

setCosts | Set up proportional transaction costs for portfolio |

addEquality | Add linear equality constraints for portfolio weights to existing constraints |

addGroupRatio | Add group ratio constraints for portfolio weights to existing group ratio constraints |

addGroups | Add group constraints for portfolio weights to existing group constraints |

addInequality | Add linear inequality constraints for portfolio weights to existing constraints |

getBounds | Obtain bounds for portfolio weights from portfolio object |

getBudget | Obtain budget constraint bounds from portfolio object |

getCosts | Obtain buy and sell transaction costs from portfolio object |

getEquality | Obtain equality constraint arrays from portfolio object |

getGroupRatio | Obtain group ratio constraint arrays from portfolio object |

getGroups | Obtain group constraint arrays from portfolio object |

getInequality | Obtain inequality constraint arrays from portfolio object |

getOneWayTurnover | Obtain one-way turnover constraints from portfolio object |

setGroups | Set up group constraints for portfolio weights |

setInequality | Set up linear inequality constraints for portfolio weights |

setBounds | Set up bounds for portfolio weights for portfolio |

setBudget | Set up budget constraints for portfolio |

setConditionalBudget | Set up conditional budget constraints for portfolio |

setCosts | Set up proportional transaction costs for portfolio |

setEquality | Set up linear equality constraints for portfolio weights |

setGroupRatio | Set up group ratio constraints for portfolio weights |

setOneWayTurnover | Set up one-way portfolio turnover constraints |

setTurnover | Set up maximum portfolio turnover constraint |

setTrackingPort | Set up benchmark portfolio for tracking error constraint |

setTrackingError | Set up maximum portfolio tracking error constraint |

setMinMaxNumAssets | Set cardinality constraints on the number of assets invested in a portfolio |

checkFeasibility | Check feasibility of input portfolios against portfolio object |

estimateBounds | Estimate global lower and upper bounds for set of portfolios |

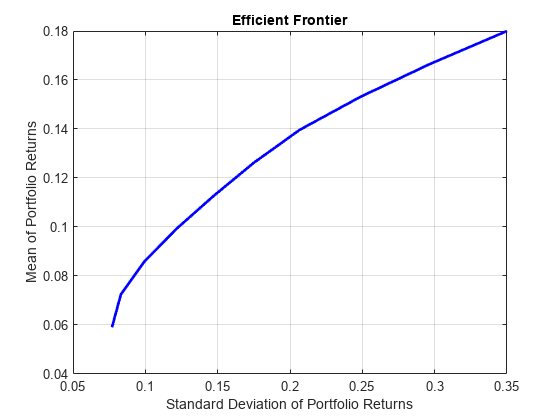

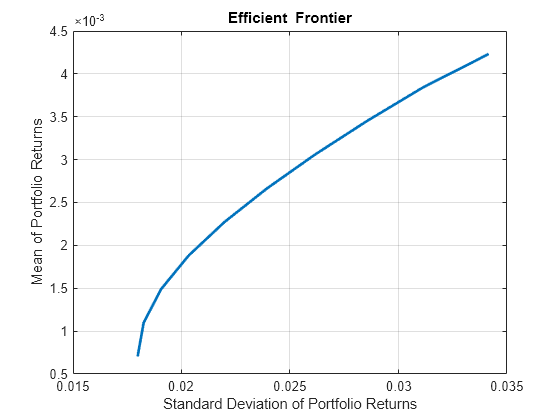

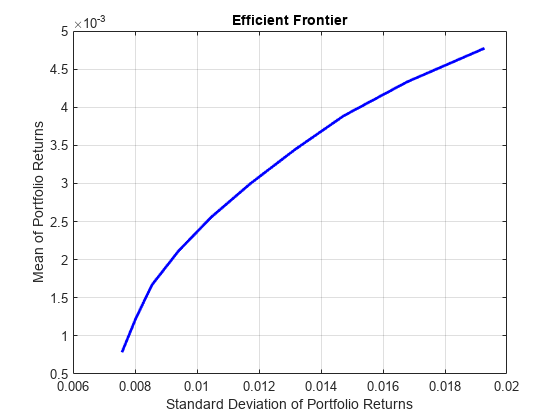

estimateFrontier | 估计有效边界上指定数量的最优投资组合 |

estimateFrontierByReturn | Estimate optimal portfolios with targeted portfolio returns |

estimateFrontierByRisk | Estimate optimal portfolios with targeted portfolio risks |

estimateFrontierLimits | Estimate optimal portfolios at endpoints of efficient frontier |

plotFrontier | 绘制有效边界 |

estimateMaxSharpeRatio | 估计有效投资组合以最大化 Portfolio 对象的夏普比率 |

estimatePortMoments | 估计 Portfolio 对象的投资组合收益矩 |

estimatePortReturn | 估计投资组合收益均值 |

estimatePortRisk | Estimate portfolio risk according to risk proxy associated with corresponding object |

estimateCustomObjectivePortfolio | Estimate optimal portfolio for user-defined objective function for

Portfolio object |

setSolver | Choose main solver and specify associated solver options for portfolio optimization |

setSolverMINLP | Choose mixed integer nonlinear programming (MINLP) solver for portfolio optimization |

示例

详细信息

参考

[1] For a complete list of references for the Portfolio object, see Portfolio Optimization.

版本历史记录

在 R2011a 中推出另请参阅

plotFrontier | estimateFrontier | PortfolioCVaR | PortfolioMAD | nearcorr | covarianceShrinkage | covarianceDenoising

主题

- 创建 Portfolio 对象

- Working with Portfolio Constraints Using Defaults

- 估计 Portfolio 对象整个有效边界上的有效投资组合

- Estimate Efficient Frontiers for Portfolio Object

- Asset Allocation Case Study

- 使用 Financial Toolbox 的投资组合优化示例

- Portfolio Optimization with Semicontinuous and Cardinality Constraints

- Black-Litterman Portfolio Optimization Using Financial Toolbox

- Portfolio Optimization Using Factor Models

- Bond Portfolio Optimization Using Portfolio Object

- Use Extended Formulation of OuterApproximation Solver Type

- Single Period Goal-Based Wealth Management

- Dynamic Portfolio Allocation in Goal-Based Wealth Management for Multiple Time Periods

- Multiperiod Goal-Based Wealth Management Using Reinforcement Learning

- Adding Constraints to Satisfy UCITS Directive

- 投资组合优化理论

- Portfolio 对象工作流

- Portfolio Object Properties and Functions

- Working with Portfolio Objects

- Setting and Getting Properties

- Displaying Portfolio Objects

- Saving and Loading Portfolio Objects

- Estimating Efficient Portfolios and Frontiers

- Arrays of Portfolio Objects

- Subclassing Portfolio Objects

- Conventions for Representation of Data

- 使用 Portfolio 对象进行投资组合优化支持的约束

- Role of Convexity in Portfolio Problems

- When to Use Portfolio Objects Over Optimization Toolbox

- Solver Guidelines for Portfolio Objects

- Choosing and Controlling the Solver for Mean-Variance Portfolio Optimization

- Choose MINLP Solvers for Portfolio Problems