setSolverMINLP

Choose mixed integer nonlinear programming (MINLP) solver for portfolio optimization

Description

obj = setSolverMINLP(obj,solverTypeMINLP)Portfolio, PortfolioCVaR, or PortfolioMAD object.

When any one or any combination of 'Conditional'

BoundType, MinNumAssets, or

MaxNumAssets constraints are active, the portfolio problem is formulated by

adding NumAssets binary variables. The binary variable 0

indicates that an asset is not invested and the binary variable 1 indicates

that an asset is invested. For more information on using 'Conditional'

BoundType, see setBounds. For more information

on specifying MinNumAssets and MaxNumAssets, see

setMinMaxNumAssets.

If you use the Financial Toolbox™

estimate functions with a Portfolio,

PortfolioCVaR, or PortfolioMAD object for which any of

the 'Conditional'

BoundType, MinNumAssets, or

MaxNumAssets constraints are active, MINLP solver is automatically used.

For details on MINLP, see Algorithms and Choose MINLP Solvers for Portfolio Problems.

obj = setSolverMINLP(___,Name,Value)

Examples

Input Arguments

Name-Value Arguments

Output Arguments

More About

Tips

You can also use dot notation to specify associated name-value options.

obj = obj.setSolverMINLP(Name,Value);

Note

The solverTypeMINLP and solverOptionsMINLP

properties cannot be set using dot notation because they are hidden properties. To set the

solverTypeMINLP and solverOptionsMINLP properties,

use the setSolverMINLP function directly.

Algorithms

When any one, or any combination of

'Conditional'

BoundType, MinNumAssets, or MaxNumAssets

constraints is active, the portfolio problem is formulated by adding NumAssets

binary variables. The binary variable 0 indicates that an asset is not

invested and the binary variable 1 indicates that an asset is invested.

The MinNumAssets and MaxNumAssets constraints narrow

down the number of active positions in a portfolio to the range of [minN,

maxN]. In addition, the 'Conditional'

BoundType constraint is to set a lower and upper bound so that the position is

either 0 or lies in the range [minWgt,

maxWgt]. These two types of constraints are incorporated into the portfolio

optimization model by introducing n variables,

νi, which only take binary values

0 and 1 to indicate whether the corresponding asset is

invested (1) or not invested (0). Here n

is the total number of assets and the constraints can be formulated as the following linear

inequality constraints:

In this equation, minN and maxN are

representations for MinNumAsset and MaxNumAsset that are

set using setMinMaxNumAssets. Also,

minWgt and maxWgt are representations for

LowerBound and UpperBound that are set using setBounds.

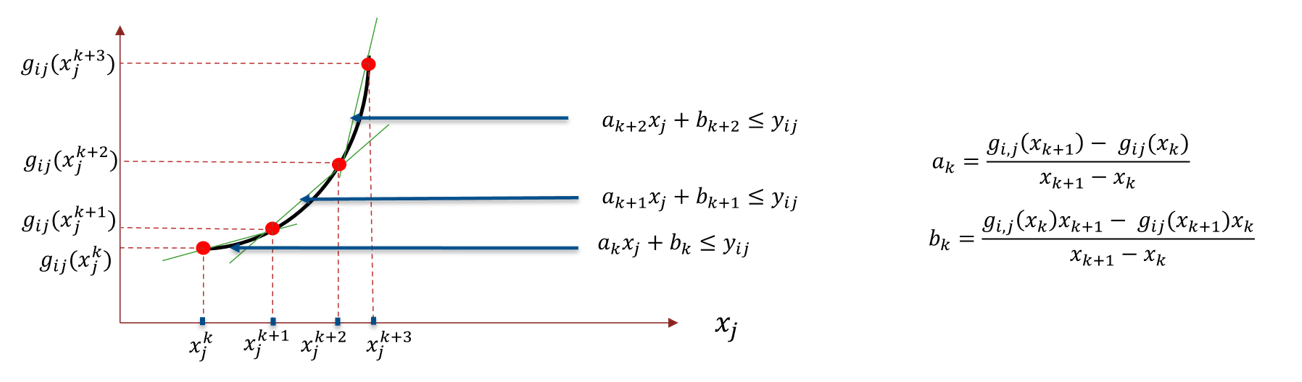

The portfolio optimization problem to minimize the variance of the portfolio, subject to achieving a target expected return and some additional linear constraints on the portfolio weights, is formulated as

In this equation, H represents the covariance and m represents the asset returns.

The portfolio optimization problem to maximize the return, subject to an upper limit on the variance of the portfolio return and some additional linear constraints on the portfolio weights, is formulated as

When the 'Conditional'

BoundType, MinNumAssets, and

MaxNumAssets constraints are added to the two optimization problems, the

problems become:

References

[1] Bonami, P., Kilinc, M., and J. Linderoth. "Algorithms and Software for Convex Mixed Integer Nonlinear Programs." Technical Report #1664. Computer Sciences Department, University of Wisconsin-Madison, 2009.

[2] Kelley, J. E. "The Cutting-Plane Method for Solving Convex Programs." Journal of the Society for Industrial and Applied Mathematics. Vol. 8, Number 4, 1960, pp. 703–712.

[3] Linderoth, J. and S. Wright. "Decomposition Algorithms for Stochastic Programming on a Computational Grid." Computational Optimization and Applications. Vol. 24, Issue 2–3, 2003, pp. 207–250.

[4] Nocedal, J., and S. Wright. Numerical Optimization. New York: Springer-Verlag, 1999.

Version History

Introduced in R2018bSee Also

optimoptions | setBounds | setMinMaxNumAssets | estimateFrontier | estimateFrontierByReturn | estimateFrontierByRisk | estimateFrontierLimits | estimateMaxSharpeRatio | setSolver

Topics

- Portfolio Optimization with Semicontinuous and Cardinality Constraints

- Mixed-Integer Quadratic Programming Portfolio Optimization: Problem-Based

- Mixed-Integer CVaR Portfolio Optimization Problem

- Mixed-Integer MAD Portfolio Optimization Problem

- Mixed-Integer Mean-Variance Portfolio Optimization Problem

- Supported Constraints for Portfolio Optimization Using Portfolio Objects

- Supported Constraints for Portfolio Optimization Using PortfolioCVaR Object

- Supported Constraints for Portfolio Optimization Using PortfolioMAD Object

- Solver Guidelines for Portfolio Objects

- Choosing and Controlling the Solver for Mean-Variance Portfolio Optimization

- Choosing and Controlling the Solver for PortfolioCVaR Optimizations

- Choosing and Controlling the Solver for PortfolioMAD Optimizations

- Choose MINLP Solvers for Portfolio Problems