Conditional Mean Models

In time series econometrics, the dynamic behavior of a variable over time is often of interest. A dynamic conditional mean model specifies the expected value of a response process yt as a function of historical information.

To model the dynamic behavior of a univariate linear conditional mean

model, use the Econometrics Toolbox™

arima function at the command line

or you can create models interactively with the Econometric

Modeler app. By using arima, you can create a

wide variety of autoregressive integrated moving average (ARIMA) models,

including optionally specifying seasonal components for a SARIMA model,

linearly adjusting for exogenous predictors for an ARIMAX model, or

specifying a GARCH variance model, for example, to create a composite

conditional mean and variance model. For more details on programmatic and

interactive ARIMA model creation, see Creating Univariate Conditional Mean Models.

For multivariate conditional mean models, see Vector Autoregression Models, and, for linear regression models that assume an ARIMA error process, see Autocorrelated and Heteroscedastic Disturbances.

Apps

| Econometric Modeler | Analyze and model econometric time series |

Functions

Topics

Interactive Workflows

- Analyze Time Series Data Using Econometric Modeler

Interactively visualize and analyze univariate or multivariate time series data. - Implement Box-Jenkins Model Selection and Estimation Using Econometric Modeler App

Interactively implement the Box-Jenkins methodology to select the appropriate number of lags for a univariate conditional mean model. Then, fit the model to data and export the estimated model to the command line to generate forecasts. - Perform ARIMA Model Residual Diagnostics Using Econometric Modeler App

Interactively evaluate model assumptions after fitting data to an ARIMA model by performing residual diagnostics. - Share Results of Econometric Modeler App Session

Export variables to the MATLAB® Workspace, generate plain text and live functions that return a model estimated in an app session, or generate a report recording your activities on time series and estimated models in an Econometric Modeler app session.

Create Model

- Select ARIMA Model for Time Series Using Box-Jenkins Methodology

Apply Box-Jenkins methodology to select an ARIMA model for the quarterly Australian consumer price index. - Creating Univariate Conditional Mean Models

Create univariate conditional mean models usingarimaor the Econometric Modeler app. - Specifying Univariate Lag Operator Polynomials Interactively

Specify univariate lag operator polynomial terms for time series model estimation using Econometric Modeler. - Modify Properties of Conditional Mean Model Objects

Change modifiable model properties using dot notation. - Specify Conditional Mean Model Innovation Distribution

Specify Gaussian or t distributed innovations process, or a conditional variance model for the variance process. - Specify t Innovation Distribution Using Econometric Modeler App

Interactively specify a t innovation distribution for an ARIMA model. - Create Autoregressive Models

Create stationary autoregressive models usingarimaor the Econometric Modeler app. - Create Moving Average Models

Create invertible moving average models usingarimaor the Econometric Modeler app. - Create Autoregressive Moving Average Models

Create stationary and invertible autoregressive moving average models usingarimaor the Econometric Modeler app. - Create Autoregressive Integrated Moving Average Models

Create autoregressive integrated moving average models usingarimaor the Econometric Modeler app. - Create ARIMA Models That Include Exogenous Covariates

Create ARIMAX models usingarimaor the Econometric Modeler app. - Create Multiplicative ARIMA Models

Create multiplicative ARIMA models usingarimaor the Econometric Modeler app. - Create Multiplicative Seasonal ARIMA Model for Time Series Data

Create a seasonal ARIMA model. - Specify Conditional Mean and Variance Models

Create a composite conditional mean and variance model.

Fit Model to Data

- Presample Data for Conditional Mean Model Estimation

Specify presample data to initialize the model. - Time Base Partitions for ARIMA Model Estimation

When you fit a time series model to data, lagged terms in the model require initialization, usually with observations at the beginning of the sample. - Box-Jenkins Differencing vs. ARIMA Estimation

Compare Box-Jenkins and ARIMA estimation. - Choose ARMA Lags Using BIC

Select ARMA model using information criteria. - Estimate Multiplicative ARIMA Model Using Econometric Modeler App

Interactively estimate a multiplicative seasonal ARIMA model. - Estimate Multiplicative ARIMA Model

Estimate a multiplicative seasonal ARIMA model. - Model Seasonal Lag Effects Using Indicator Variables

Estimate a seasonal ARIMA model by specifying a multiplicative model or using seasonal dummies. - Estimate ARIMAX Model Using Econometric Modeler App

Interactively specify and estimate an ARIMAX model. - Estimate Conditional Mean and Variance Model

Estimate a composite conditional mean and variance model. - Infer Residuals for Diagnostic Checking

Infer residuals from a fitted ARIMA model. - Maximum Likelihood Estimation for Conditional Mean Models

Learn how maximum likelihood is carried out for conditional mean models. - Conditional Mean Model Estimation with Equality Constraints

Constrain the model during estimation using known parameter values. - Initial Values for Conditional Mean Model Estimation

Specify initial parameter values for estimation. - Optimization Settings for Conditional Mean Model Estimation

Troubleshoot estimation issues by specifying alternative optimization options.

Generate Simulations or Impulse Responses

- Simulate Stationary Processes

Simulate stationary autoregressive models and moving average models. - Simulate Trend-Stationary and Difference-Stationary Processes

Illustrate the distinction between trend-stationary and difference-stationary processes by simulation. - Simulate Multiplicative ARIMA Models

Simulate sample paths from a multiplicative seasonal ARIMA model. - Simulate Conditional Mean and Variance Models

Simulate responses and conditional variances from a composite conditional mean and variance model. - Plot the Impulse Response Function of Conditional Mean Model

Plot the impulse response function of univariate autoregressive moving average models. - Monte Carlo Simulation of Conditional Mean Models

Learn about Monte Carlo simulation. - Presample Data for Conditional Mean Model Simulation

Learn about presample requirements for simulation. - Transient Effects in Conditional Mean Model Simulations

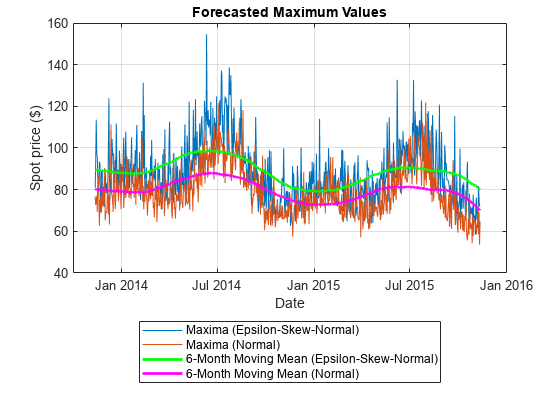

Learn how to minimize transient effects. - Volatility Modeling for Soft Commodities

This example demonstrates a diverse set of statistical methods, machine learning techniques, and time-series models that you can apply broadly in the field of volatility modeling.

Generate Minimum Mean Square Error Forecasts

- Compare Predictive Performance After Creating Models Using Econometric Modeler

Interactively choose lags for an ARIMA model by comparing the AIC values of estimated models. Then, export several models to the command line to compare their predictive performance. - Forecast Multiplicative ARIMA Model

Forecast a multiplicative seasonal ARIMA model. - Convergence of AR Forecasts

Evaluate the asymptotic convergence of forecasts from an AR model, and compare forecasts made with and without using presample data. - Forecast Conditional Mean and Variance Model

Forecast responses and conditional variances from a composite conditional mean and variance model. - Forecast IGD Rate from ARX Model

Forecast an ARIMAX model by computing MMSE forecasts or using Monte Carlo simulation. - Specify Presample and Forecast Period Data to Forecast ARIMAX Model

This example shows how to partition a timeline into presample, estimation, and forecast periods, and it shows how to supply the appropriate number of observations to initialize a dynamic model for estimation and forecasting. - Monte Carlo Forecasting of Conditional Mean Models

Learn about Monte Carlo forecasting. - MMSE Forecasting of Conditional Mean Models

Learn about MMSE forecasting.